The cryptocurrency market rebounded on Monday after a volatile second week of October that erased earlier gains. Major tokens, including Bitcoin and Ethereum, surged amid renewed optimism for a U.S. Federal Reserve rate cut later this month.

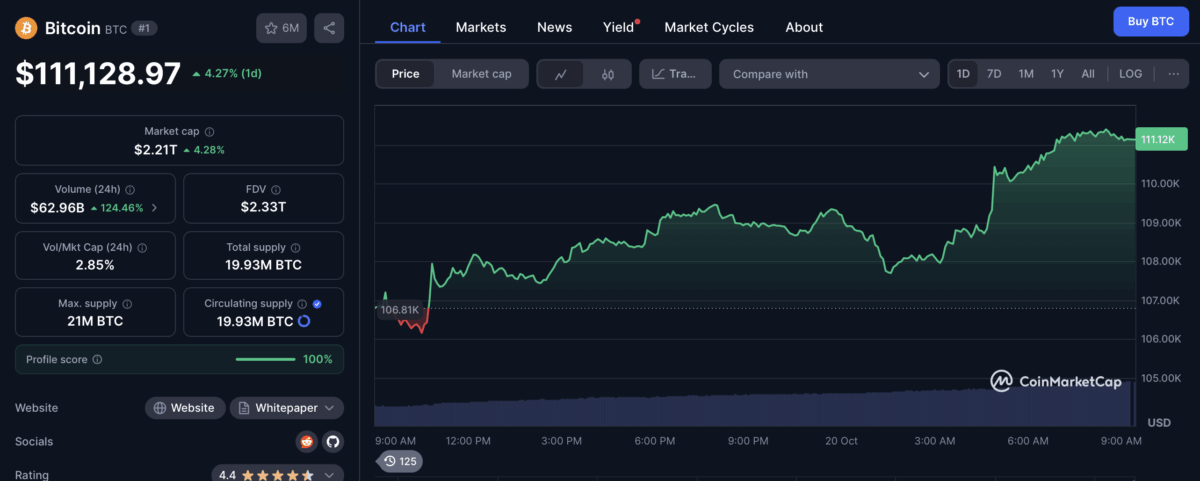

At the time of writing, Bitcoin, the largest cryptocurrency by market capitalization was trading for $111,150, up 4.2% in the last 24 hours after closing last week below $105,000. The rally came alongside a 118% spike in trading activity, with over $61 billion in volume, according to CoinMarketCap.

Ethereum is also up today by 3.9% and has reclaimed its $4,000 level. Currently, it’s trading at $4,035 after dropping to $3,900 last Friday. In fact, the overall market is up 4.21% today with a total capitalization of $3.76 trillion, with a 70% surge in daily trading volume of over $165 billion, according to CoinMarketCap.

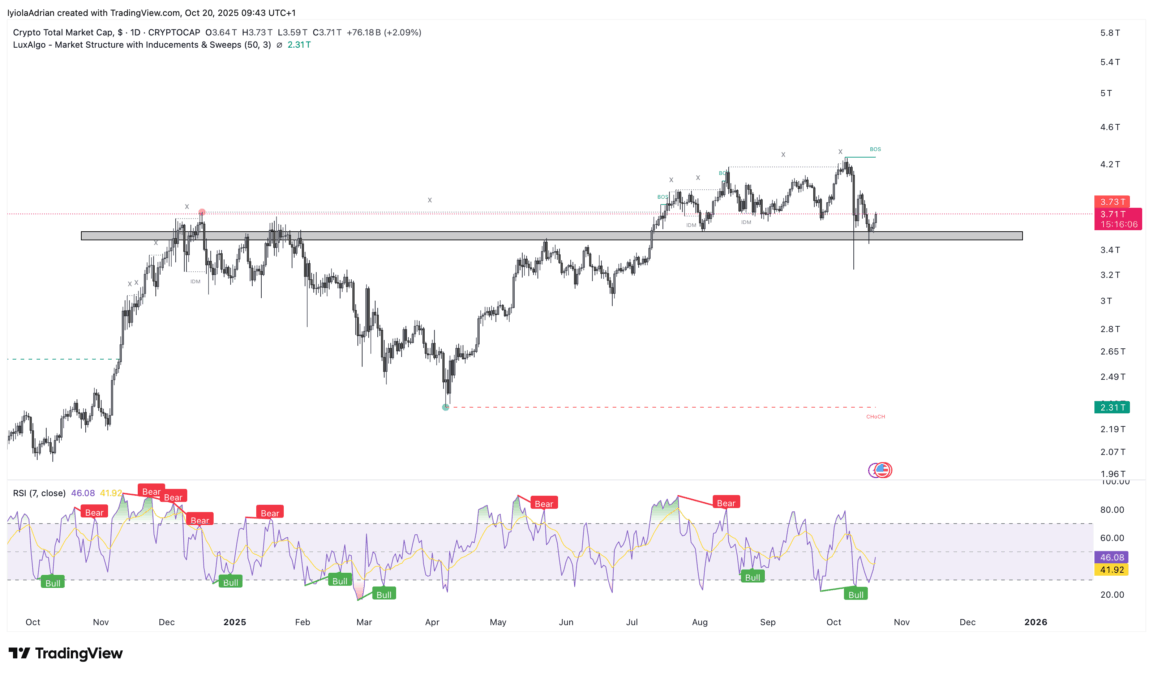

Market capitalization finds support at $3.6 trillion

This rebound follows two weeks of price corrections that initially pushed the total market cap as low as $3.45 trillion, before stabilizing near the $3.6 trillion support zone. In addition to that, the Relative Strength Index (RSI) is at 46, suggesting selling pressure has eased and bullish sentiment is reemerging.

Moreover, the Fear and Greed index has recovered from 22 (extreme fear) to 30, reflecting cautious optimism among investors.

One other reason for the surge today is the expectation of a U.S. Federal Reserve rate cut. According to CME FedWatch Tool, there’s a 100% chance that the Fed will announce a rate cut at its October 29 meeting. Rate cuts usually help the financial markets as it makes borrowing funds cheaper for investors. This then encourages them to take more risk and invest more into the market.

$332 million in shorts liquidated

The sudden price recovery triggered heavy liquidations across derivatives exchanges. More than $493 million in leveraged positions were liquidated over the past 24 hours, including $322 million from traders who bet against the market, according to Coinglass data.

Also Read: Bitcoin Treasury Stocks Collapse, Retail Investors Lose $17B