Bitcoin’s price fell below $105,000 today, to a 15-week low as traders reacted to fears surrounding U.S. regional banks and tensions with China.

As of the time of writing this report, Bitcoin (BTC) is trading for $104.767. The cryptocurrency has dropped by 5.37% in the last few hours, adding up to 13.95% over the week, with a market value of $2.1 trillion. Trading activity has jumped 59% to $114 billion as investors rush to sell

Data from Farside Investors also recorded that U.S. spot Bitcoin ETFs saw over $530 million in outflows today. This was led by ARK Invest’s ARKB with $275.2 million leaving the market. Fidelity’s FBTC followed with $132 million in redemptions.

Gold advocate Peter Schiff commented on the drop on X, claiming that gold could reach $1 million before Bitcoin.

“It’s not just a de-dollarization trade but a de-bitcoinization trade. Bitcoin has failed the test as a viable alternative to the U.S. dollar or digital gold.” He said in another tweet.

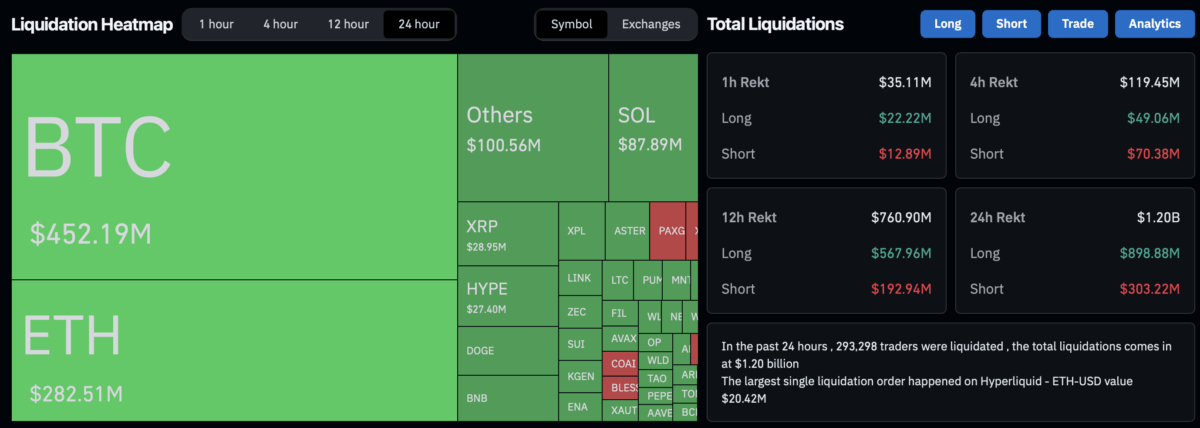

Additionally, over $1.20 billion in crypto has been liquidated because of the drop in overall market. According to data from Coinglass, $898 million alone came from traders who had placed their bets on long positions.

Meanwhile, gold has continued to surge. It even hit another record high of $4,380.79 per ounce, pushing its market cap to $30 trillion.

Also Read: $1.23B Wiped Out as Crypto Market Faces Sharp Fall in Weeks