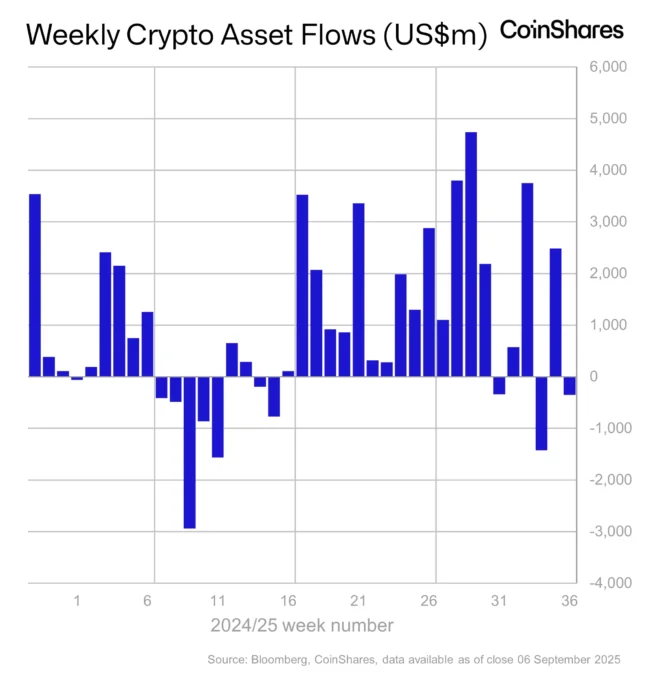

Brazil registered $5.4 million (R$28.8 million) in net inflows into crypto funds last week, tracking a global surge of $3.3 billion, according to data from CoinShares. The move reflects renewed investor optimism fueled by expectations of a U.S. Federal Reserve rate cut on September 17.

The U.S. led inflows with $3.3 billion, followed by Germany ($160.2 million), Canada ($14.1 million), Hong Kong ($5.4 million), and Australia ($2.4 million). Switzerland and Sweden went against the trend, recording outflows of $92.1 million and $5.6 million, respectively.

Brazil advanced its assets under management (AuM) to $1.68 billion, maintaining sixth place globally behind the U.S. ($165.79 billion), Switzerland ($7.92 billion), Germany ($7.55 billion), Canada ($7.31 billion), and Sweden ($4.01 billion).

Single-asset crypto funds dominate as multi-asset products see outflows

Bitcoin funds led with $2.4 billion in inflows, followed by Ethereum products at $645.9 million and a record $198.4 million for Solana, while XRP and Sui added $32.5 million and $14 million. BlackRock’s iShares Bitcoin and Ethereum ETFs topped institutional flows with $1.11 billion, trailed by Fidelity’s Wise Origin Bitcoin Fund at $850 million, alongside gains for ARK 21 Shares, Bitwise, and Grayscale.

In contrast, multi-asset funds posted $1.1 million in outflows, and 21Shares AG and CoinShares XBT Provider AB recorded $94 million and $6 million in withdrawals, underscoring a selective appetite for single-asset products.

The takeaway

Brazil’s steady inflows mirror a global bet that crypto is clawing its way deeper into the mainstream as monetary policy shifts. Bitcoin and Ethereum funds are regaining traction, Solana is breaking records, and the market is lining up ahead of the Fed’s decision — a verdict that could dictate whether institutional demand surges or stalls.

Also read: PayPal Introduces ‘PayPal links’ For Simplified P2P Payments