Blockchain smart contracts are capable of changing the way information flows in our society by creating systems that provide more autonomy to individuals. But smart contracts are only as useful as the data they are fed. It is Chainlink that connects smart contracts to real time data like weather forecasts, event outcomes, predictions, market trends or asset prices.

Chainlink is well-known in the blockchain ecosystem owing to its undisputed security and dependability. It enhances the ability to create secure and automatic applications by connecting blockchains with the real world.

What is Chainlink?

Chainlink is a hybrid blockchain network that communicates and connects blockchains with off-chain data. It a decentralized oracle network- a third party service used to verify external data sources before transmitting the information to smart contracts.

Launched in 2017, this oracle network operates as a bridge connecting blockchain and smart contracts to real-world data, services and systems. The functionalities of Chainlink allow to create powerful and more flexible blockchain applications for use cases such as decentralised finance (DeFi) applications and blockchains with access to reliable off-chain data.

Features of Chainlink

Chainlink offers various features that developers can use to build DeFi applications. Some of its core features include:

- Supporting Decentralized Data Feeds: Hybrid smart contracts safely gather and handle data from a variety of sources.

- Providing Source of Randomness: Chainlink can be used in applications like games that cryptographically secure randomness.

- Enabling Automation: Chainlink smart contracts enable businesses to automate event-driven chores and essential operations.

- Facilitating Interoperability across Blockchains: Chainlink has the capacity to link blockchain platforms to facilitate the sharing of coins, messages, and particular activities.

Use Cases of Chainlink

Chainlink has emerged as a key player in the blockchain landscape as it provides an interface between smart contracts and the outside world. The following are important use cases of Chainlink.

Decentralized Finance (DeFi)

Chainlink is a leading provider of price feeds for various assets, such as cryptocurrencies, commodities, and even fiat currencies. These price feeds are crucial for lending protocols, decentralized exchanges, and stablecoins because DeFi platforms depend on stable price inputs for their operations.

Insurance

Now smart contracts can trigger automatic claims with advanced preconditions. Chainlink can grant insurance contracts access to data inputs, which are required for both, initiating the contract and its settlement. Chainlink facilitates bi-directional data flow into and out of the smart contract with the same properties of its decentralized backend.

Gaming and Non-Fungible Tokens (NFTs)

Chainlink’s relevance to gaming and NFT is profound through its Verifiable Randomness Function (VRF). This VRF helps in bringing a new level of integrity while generating in-game items and NFTs. This guarantees fair gameplays.

Supply Chain Management

Through internet of things (IoT) devices and sensors, Chainlink provides assistance to improve transparency in the supply chain, to secure transfer of real-time data to smart contracts, tracking goods easily, verifying a product’s authenticity, and in the process of compliance with regulations.

Cross-Chain Communication

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) enables different blockchain networks to interconnect, allowing them to transact across chains safely.

Data Marketplaces

With Chainlink, developers can now access verified data easily from various providers, and data providers to monetize their information securely through blockchain-based data marketplaces.

Chainlink Price Oracle

Chainlink Data Feeds or Price Oracles are smart contracts and an integral part of the Chainlink infrastructure which work towards pricing various assets, including cryptocurrencies, commodities and fiat currencies. Oracle prices are crucial for DeFi platforms and reliable governance tokens, which ensure safe and precise deals for users.

Price oracles operate by accumulating information from different sources and thereafter, passing the data to the smart contracts on-chain, where it can easily be accessed. The absence of a master node in the Chainlink oracle network prevents any single point of failure as the data is dispersed across different nodes, thereby, reducing the chances of data meddling and alteration.

Some of the characteristics of Chainlink Price Oracle are:

- Accuracy: Trusted providers are used as data sources and aggregated information is checked.

- Security: Manipulation or hacking is prevented by the decentralized architecture.

- Transparency: Aggregated data and sources are available for monitoring in real time.

- Reliability: Chainlink promises availability and dependability, regardless of market turbulence.

These oracles support many DeFi applications such as lending services, derivatives, or stablecoins, by maintaining required accuracy in price feeds to ensure that the smart contracts are executed properly.

Chainlink Price Oracles play a foundational role in the creation of the web and building blocks of blockchain ecosystems with advanced use cases integrated into systems with useful data.

Chainlink’s Native LINK Token

The Chainlink network uses LINK as its key cryptocurrency that serves as the backbone of the oracle system. Also, LINK is an ERC-677 token that allows it to inherit benefits of the ERC-20 standard. This fulfils the base functionalities in addition to providing services like transferring tokens with data payloads.

The LINK tokens are used to pay for node operators in order to retrieve data for smart contracts. Besides, node operators will often be required to stake LINK tokens, which act as collateral to guarantee safe and accurate operations. This encourages to maintain the network’s security and operational standards.

As on April 28, LINK is trading near $14.68 with a market cap of $9.66 billion. It is currently the 12th largest crypto asset by market cap – as per CoinMarketCap data.

How to Buy LINK Token?

Purchasing Chainlink’s LINK token becomes a simple task through our step-by-step guide.

Step 1: Select Cryptocurrency Exchange

The LINK token is listed on almost all leading cryptocurrency exchanges, like Binance, Coinbase, Kraken and KuCoin. Be sure that the exchange that you select is one of the most trustworthy and reliable crypto exchanges and has LINK in their trading list.

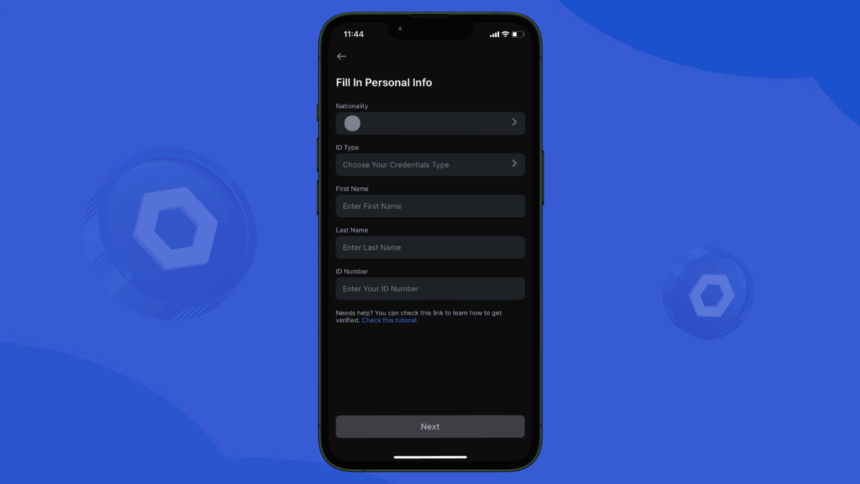

Step 2: Select and Verify Account

Set up an account on the selected exchange. Fill in the required ‘Know Your Customer’ (KYC) details by providing personal and identification documents, mandatory by law.

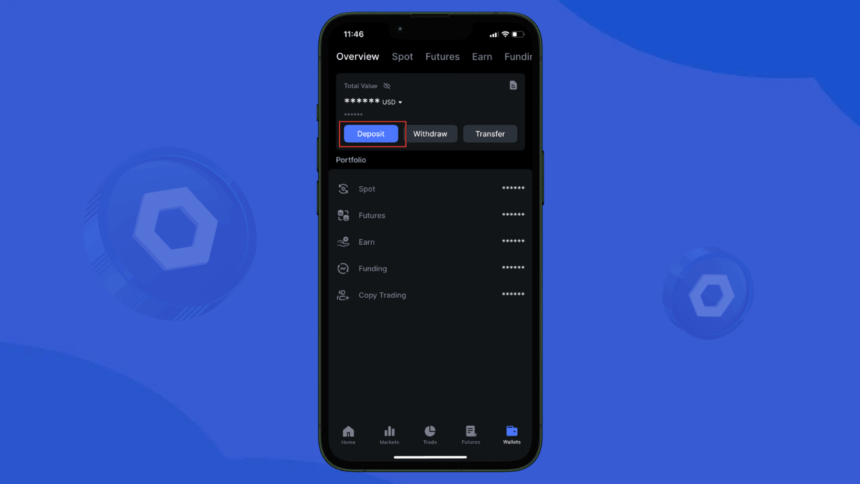

Step 3: Deposit Funds

Fund your account for purchasing LINK. To do so:

- Deposit funds in fiat currency using a payment mode: a bank wire transfer, a debit or credit card, or any other.

- Deposit other cryptos like Bitcoin or Ethereum, with the intention of converting them into LINK.

Step 4: Locate LINK in Exchange

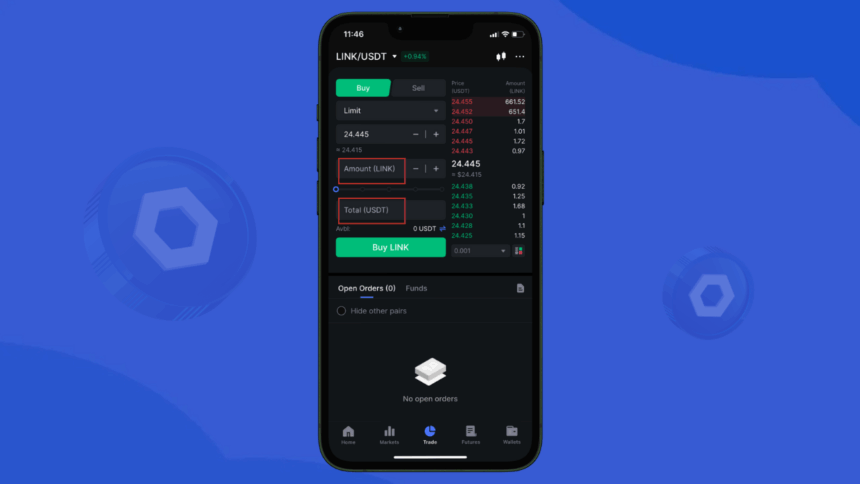

Try looking for LINK tokens under the trading section of the exchange. Also, check commonly available pairs such as LINK/USD, LINK/ETH or LINK/BTC.

Step 5: Submit Order

Decide the amount you wish to invest in LINK and place an order:

- Market Order: If you wish to buy LINK without delay, select the market order which executes the trades immediately at current price.

- Limit Order: It allows you to buy or sell the asset at a specified price.

Future of Chainlink

Chainlink is anticipated to remain the backbone of blockchain development as the use of DeFi and smart contracts expands. Its decentralized oracle network is crucial for advanced blockchain networks, offering uninterrupted off-chain data supply.

In the coming years, Chainlink’s contribution to DeFi will likely increase, helping more complex financial instruments such as traditional derivatives and parametric insurance to achieve real-time information. Moreover, its CCIP feature allows sending of data and functions between blockchains, improving connectivity and smooth functioning.

Conclusion

Chainlink’s interest in blockchains’ scalability and integration of real world data could lead to wider acceptance in other fields such as gaming, supply chain or insurance. The growing demand for stable data feeds and dApps makes Chainlink an important platform for a decentralized economy.

Also Read: Pi Coin Eyes $2.5 After Pi Network Integrates with Chainlink