Prestige Wealth Inc. announced on Friday that it is rebranding to Aurelion Treasury to launch Nasdaq’s first Tether Gold-backed corporate reserve.

This came shortly after the firm secured $150 million in new funding to build a new kind of digital gold treasury that connects real gold with blockchain technology. The rebrand, which is subject to regulatory approval, will take effect on October 13, 2025, when the company begins trading under its new ticker, AURE.

Big Funding for a Gold-Backed Future

In the press release, the firm said it raised $100 million through a Private Investment in Public Equity financing round led by Antalpha Platform Holding Company.

Another $50 million came from a loan provided by Antalpha Management, which brings the total funds to $150 million, according to a filing with the U.S. Securities and Exchange Commission. Aurelion said it plans to use most of the proceeds to acquire Tether Gold (XAUT), an on-chain gold-backed treasury on Nasdaq.

Incoming CEO Björn Schmidtke, who previously co-founded the Bitcoin mining company Penguin Group, said the new treasury is meant to create a new standard for digital wealth. “I am bullish on Bitcoin long term, but Tether Gold represents real, redeemable value — the true digital gold,” Schmidtke said.

Antalpha CFO Paul Liang said the partnership is a step to make digital gold easier for people to understand and use. “Digital assets will be more tangible to many when one can walk into a jewelry store and redeem a gold bar with Tether Gold,” he emphasized. Antalpha plans to use its Real-World Asset Hub to make gold redemptions simpler, so that holders can exchange tokens for real gold bars in the future.

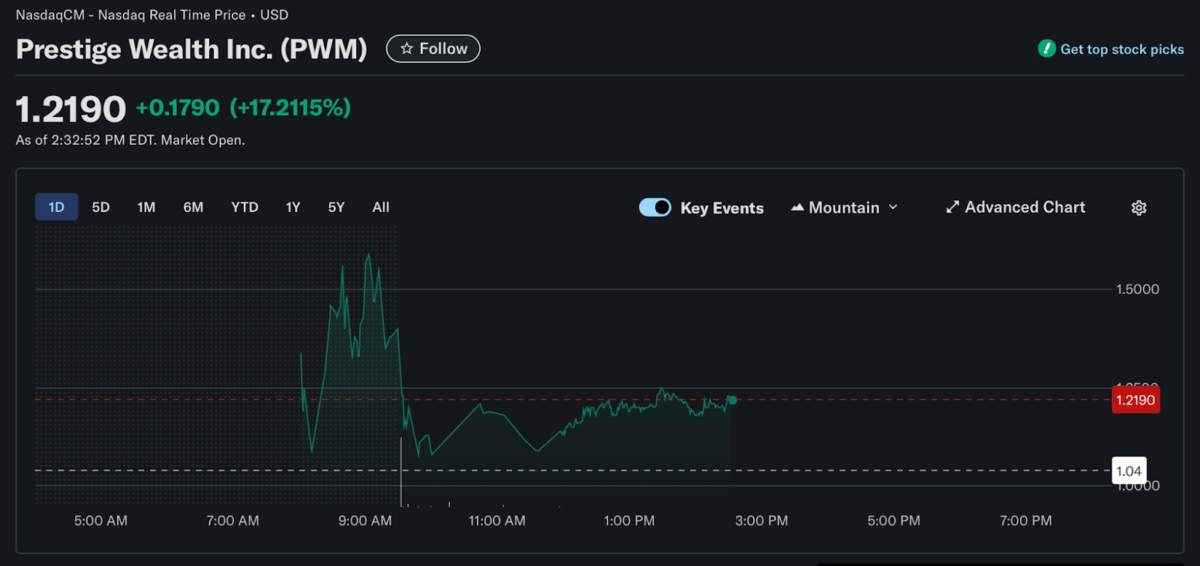

Share Surge 17% Following the News

After the news, shares of Prestige Wealth, which still trade under the ticker PWM, jumped by about 17% on Friday, with its market value reaching around $57 million, according to Yahoo Finance. At the time of writing, the share is trading for $1.2190.

Aurelion’s plan makes it the first time a Nasdaq-listed company will hold tokenized gold as a main reserve.

Also Read: Australia’s $4.2T Super Funds Redefining Global Investment Flows