Bitcoin hit a new all time high yesterday, October 6 following a strong momentum as the “Uptober” month unfolds. However, this comes as none of its 30 bull market peak indicators have hit.

At the time of publishing, Bitcoin is trading near $120,988, down 3.38% from its daily high. It witnessed a 17% surge in trading activity today, leading to $77 billion in trading volume, as per CoinMarketCap data.

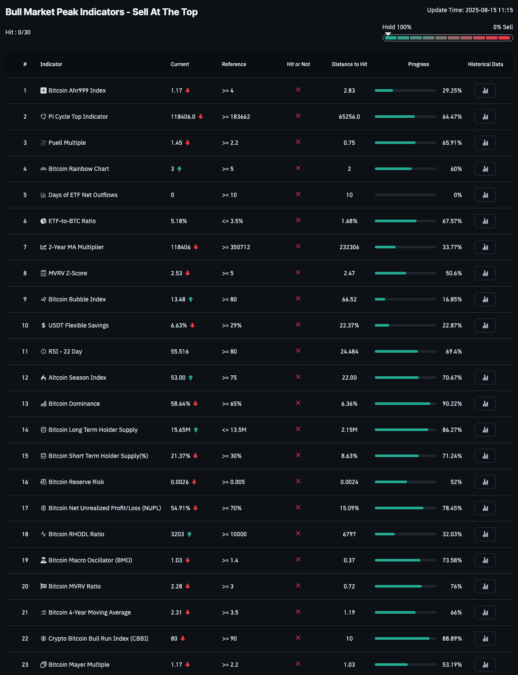

Meanwhile, investors still remain confident that the rally is not over yet and a further upward trajectory is still certain with data from CoinGlass categorizing Bitcoin as a “hold 100%” asset based on its top 30 bull market indicators.

CoinGlass’s top 30 bull market indicators form a comprehensive dashboard tracking Bitcoin’s cycle through metrics like the Pi Cycle Top, MVRV ratio, and Ahr999 Index, covering price, on-chain activity, and sentiment. Currently, none of these indicators signal a market top, supporting the “hold 100%” rating and suggesting potential for Bitcoin to climb to new highs.

In a statement to The CryptoTimes, the CEO & Co-founder of VALR, Farzam Ehsani, said that “Bitcoin’s new all-time high and surge past $125,000 is driven by the convergence of multiple tailwinds kicking into the market simultaneously. These converging factors are vital for understanding the trajectory of the market in Q4.”

Bitcoin and ‘Uptober’ Season

The recent surge in Bitcoin price is largely fueled by demand from institutional investors and also macroeconomic factors that favor assets like high risk. Based on this buying pressure, analysts predict that Bitcoin has the tendency to climb up to $135k this year as the momentum holds.

“Seasonal strength is adding further fuel to the BTC’s rally fire,” Ehsani notes, adding, “Historically, Bitcoin has posted gains in 10 of the last 12 Octobers and 8 of the past 12 Q4s. This is setting expectations that the current breakout move, which saw BTC move from $110,000 to $125,000 in one week, could extend further and withstand the selling pressure and profit-taking usually triggered when Bitcoin hits a new all-time high.”

In addition, Market sentiment is turning more bullish, as the Crypto Fear and Greed Index edges toward greed. Currently, the index is at 64, according to CoinMarketCap, and this suggests that investors are actively confident in the market.

Also Read: BlackRock’s Top ETF Is Just a Hair Away from $100 Billion