Ondo Global Markets has surpassed $300 million in tokenized equities within a month of its launch. Ondo’s fund scale has reached around $1.4 billion in this segment, ranking second after Securitize, which is at $2.72 billion.

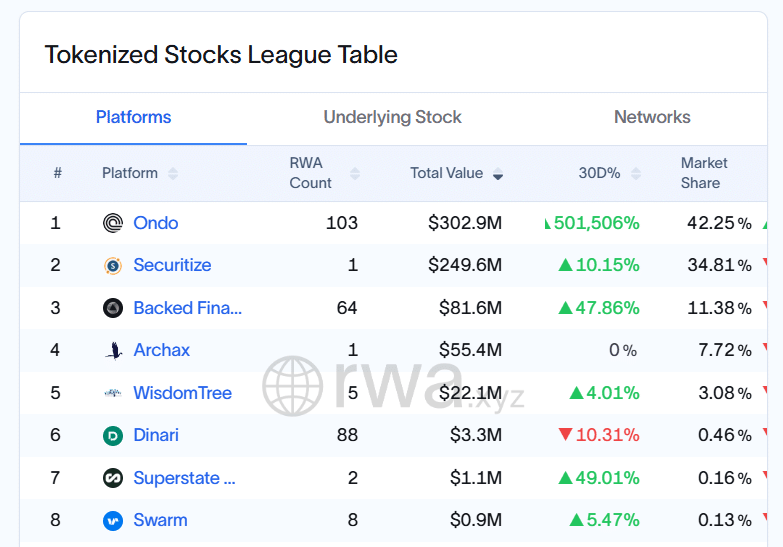

According to data by RWA.xyz, the real-world asset tokenized (RWA) stock market has reached a total capitalization of $716.95 million, reflecting a 97.09% increase over the past 30 days.

Ondo Global Markets leads the sector with 103 tokenized stocks valued at $302.9 million, holding over 42% of the market share, followed by Securitize at $249.6 million and Backed Finance at $81.6 million. This accomplishment puts Ondo at the top of the RWA tokenization market.

Rise of tokenized assets

The milestone achieved by Ondo Global comes at the same time as a big rise in the industry as a whole. Dune and RWA.xyz’s joint report says that the RWA tokenization market has grown to more than $300 billion, a 224% increase since the start of 2024. Tokenization is making previously institutional-only assets more accessible, says the report.

Platforms like Ondo are a big part of this change. During its first week of launch, Ondo generated over $141 million in mint/redeem volume, which indicates that there is a lot of demand for tokenized equities.

Also Read: Tether to Roll Out USAT on Rumble Platform