FG Nexus has accumulated 50,000 Ethereum (ETH) for its corporate treasury, now valued at $210.1 million, following a strategic pivot announced in August. The firm disclosed the holdings on Tuesday, triggering a 4.5% surge in pre-market trading of its stock (FGNX). The average purchase price across all transactions stands at approximately $3,860, according to the company.

While this acquisition has placed FG Nexus in a strong position in the corporate Ethereum treasury race, it still trails Bitmine Immersion Technologies (BMNR), which holds over 2.4 million ETH—roughly 2% of the circulating supply. FG Nexus, meanwhile, is targeting a more aggressive 10% stake. Over the past week alone, it added 285 ETH to its reserves, citing Ethereum’s $4,200 market price at the time of purchase.

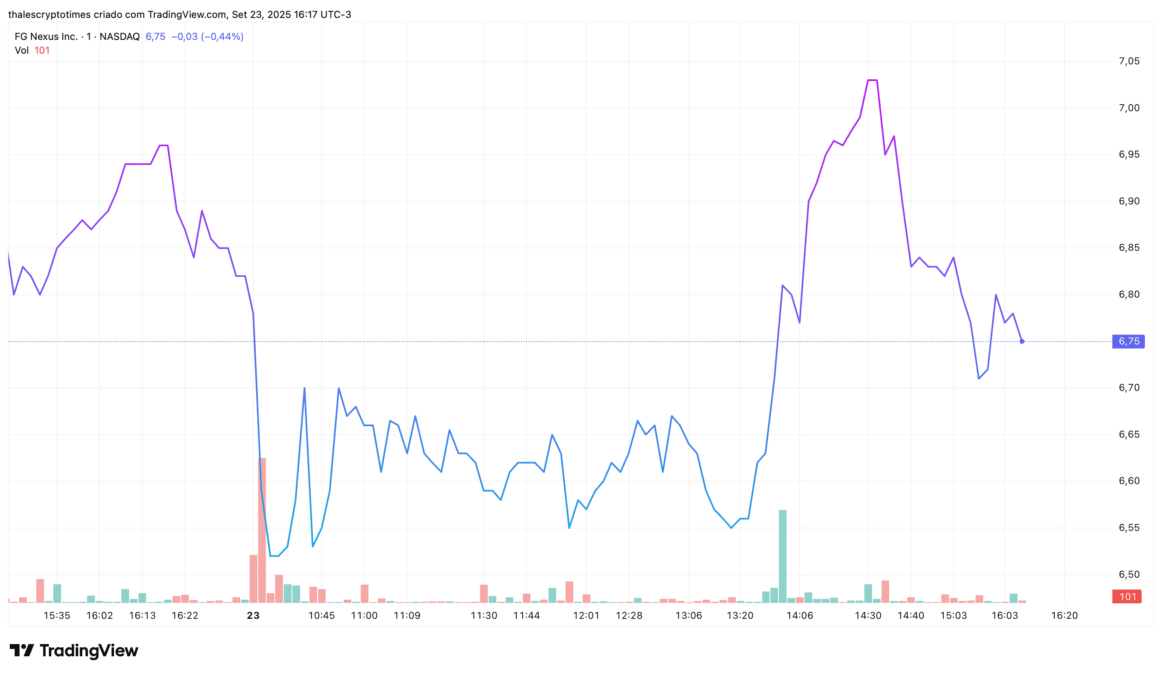

FGNX lags performance but intensifies ETH race

Despite Tuesday’s gains, FGNX shares remain down 68% year-to-date and 71% over the past 12 months. However, retail sentiment appears to be shifting.

BMNR, led by Tom Lee, also saw pre-market gains of 2% and continues to draw interest with its Ethereum accumulation strategy. While Bitmine currently leads the supply race, FG Nexus’ latest move signals that the contest for ETH dominance among publicly traded firms may be far from over.

Also read: FG Nexus Becomes Major ETH Holder with 47,331 ETH