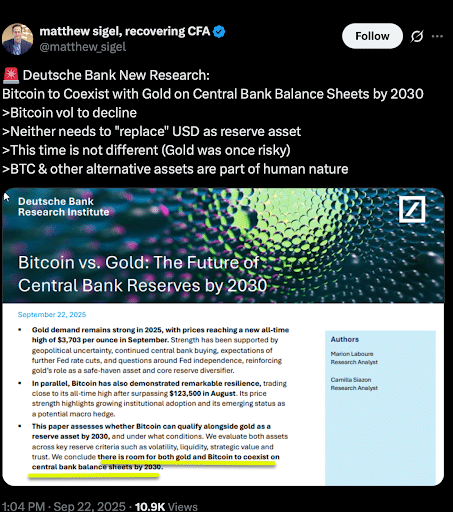

In a recent report, Deutsche Bank, one of the biggest investment banks in the world, gave a prediction that the central banks could soon start holding Bitcoin just like they hold gold, and this might happen by the year 2030.

The research has become a topic of discussion among crypto investors, after Matthew Sigel, Head of Digital Asset Research at VanEck, pointed it out in public, and it picked up interest because this would be the first time central banks use Bitcoin as part of their official reserves.

Bitcoin will stand beside gold, not replace it

The bank explained that Bitcoin will not fight gold for position, but will instead stand beside it. Moreover, both assets are seen as “safe” places to keep value during hard times in the economy. The report said that the central banks may slowly add more Bitcoin and gold into their reserves.

“So long as we are human, Bitcoin and other alternative assets will likely continue to compete for our attention.” Deutsche Bank wrote.

One reason behind this idea is due to Bitcoin’s limited supply. Out of its maximum cap of 21 million coins, nearly 19.92 million are already in circulation, which means about 95% is already unlocked. The final 5% will only be mined over the next 115 years, which would make the cryptocurrency scarce as time goes on.

With its current market cap standing at $2.2 trillion, the bank said scarcity and its reputation as a hedge against inflation could drive governments to include it in their reserves.

Lessons from gold’s past

The report also compared Bitcoin to gold’s early history. At an early stage, Gold was not always trusted, it faced doubts from investors and saw huge drops in its price.

It even went through a 60% price fall between 1980 and 2001 before becoming one of the most important assets in the world. Today, the asset is worth more than $20 trillion.

Deutsche Bank believes Bitcoin is following a similar path, with regulation and liquidity helping it mature. The bank also stressed that Bitcoin’s volatility will ease as adoption grows, just like gold became more stable over time.

The research further pointed out that both assets are hitting record highs. In 2025, gold climbed to $3,703 per ounce, while Bitcoin reached $123,500 per coin. The bank said this thanks to the weakness in the dollar, as well as doubts about the independence of the US Federal Reserve.

However, Deutsche Bank noted that Bitcoin and gold will not replace the US dollar. Instead, the dollar will stay the main reserve, while gold and Bitcoin act as extra safe assets.

Also Read: Michigan’s Bitcoin Reserve Bill Progresses after Months of Delay