ARK Investment Management LLC (ARK) has doubled down on Solmate (Nasdaq: BREA), purchasing nearly $162 million worth of shares on the open market after participating in the company’s $300 million funding round.

Solmate, formerly known as Brera Holdings, a sports club ownership company, has reinvented itself by raising $300 million to build a digital asset treasury on the Solana network. The oversubscribed funding round drew capital from prominent investors, including ARK Invest, Pulsar Group, RockawayX, and the Solana Foundation.

Following its initial investment in the round, Cathie Wood’s firm acquired an additional 6.5 million BREA shares across its flagship ETFs—ARKK, ARKW, and ARKF—staking a louder claim on Solana’s growing institutional presence.

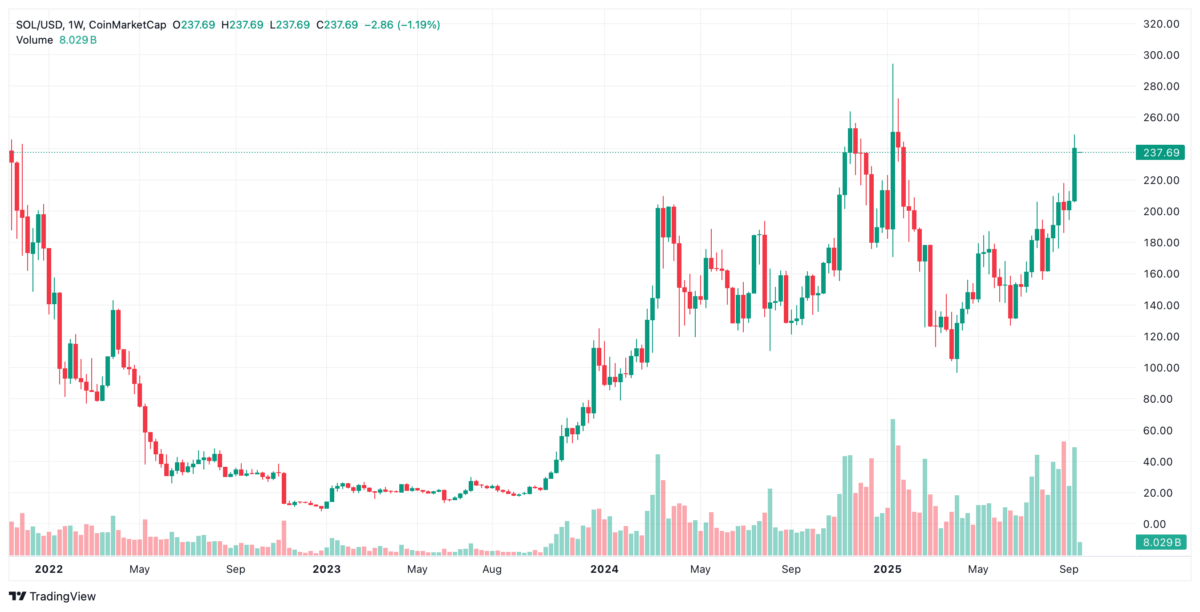

Cathie Wood’s firm piled in further, snapping up 6.5 million BREA shares across its flagship ETFs — ARKK, ARKW, and ARKF — staking a louder claim on Solana’s growing dominance in the digital asset race. The investment sparked a frenzy, with BREA soaring 225% in a single day before closing at $24.90. The rally mirrored Solana’s rise past $250, up more than 20% this month. For investors, ARK’s bet signals accelerating institutional appetite for Solana-linked exposure and digital asset treasuries.

With Solmate’s explosive debut and SOL’s climb, ARK is aligning itself with one of crypto’s strongest bullish narratives — the mainstreaming of tokenized treasuries powered by fast, low-cost blockchains.

Also read: Brera Holdings Rebrands as “Solmate” After $300M Solana Deal