European regulators are warning that the financial system is facing an increase in cyberattacks and growing exposure to crypto-assets. The assessment, outlined in the latest risk report from the European Supervisory Authorities (ESAs), highlights the need for a more resilient system as digital markets become more integrated with traditional finance.

The message is clear: build resilience or risk being blindsided as digital markets bleed further into traditional finance.

Cyber threats in focus

The EU Agency for Cybersecurity (ENISA) has flagged a sharp growth in attacks, with banks and market infrastructure hammered by ransomware and DDoS campaigns often fueled by geopolitical tensions.

To reinforce defenses, the Digital Operational Resilience Act (DORA), which became applicable as of January 17, 2025, now compels banks and market operators to harden defenses, tighten reporting, and confront risks linked to critical ICT suppliers. It’s a legislative warning shot: patch the cracks fast, or cybercriminals and hostile states will happily exploit them.

Crypto’s rise tests regulators and banks alike

Regulators admit contagion risks from decentralized finance (DeFi) remain limited for now, but the links between banks and digital assets are tightening fast. The ESMA report shows that pro-crypto moves under President Trump ignited a surge that drove total crypto market capitalization to a record €3.3 trillion by the end of 2024.

That momentum didn’t last. By April 2025, valuations had plunged 18% to €2.7T as macroeconomic headwinds set in. Despite the slide, banks have continued to expand their exposure to the digital sector by rolling out new services that blur the line between crypto and traditional finance.

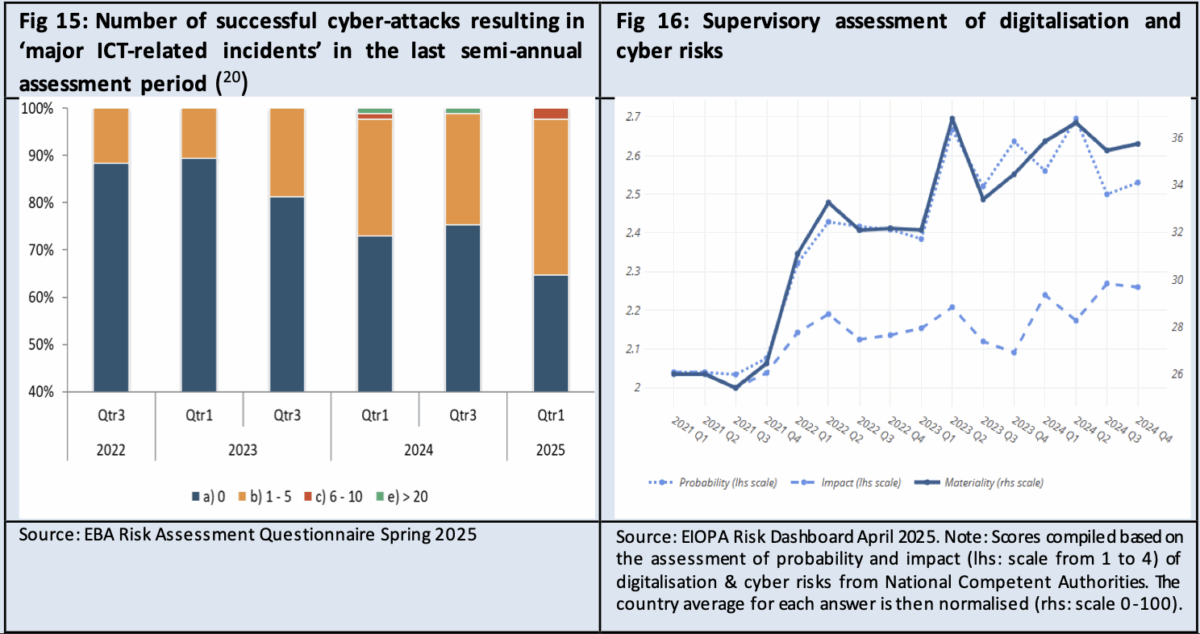

For regulators, the concern has shifted: not whether crypto grows, but whether the system can absorb the shock when its volatility spills over into the mainstream. The report’s EBA and EIOPA cyber risk data shows a continued upward trend in digital threats to the financial sector, with risks remaining at a high to very high level in the second half of 2025.

Regulators say the message is clear: as blockchain adoption deepens and Wall Street–style engagement accelerates, firms must reinforce cyber defenses and prepare for a future where crypto is fully woven into traditional finance. For investors, the opportunity is real, but so are the risks now firmly on the radar.

Also read: Malta resists France’s push to centralize EU crypto rules