Shares of crypto exchange Gemini (GEMI) have fallen nearly 24% since its initial public offering (IPO) last week, signaling a sharp reversal in early investor excitement and raising questions about its high valuation amid significant financial losses

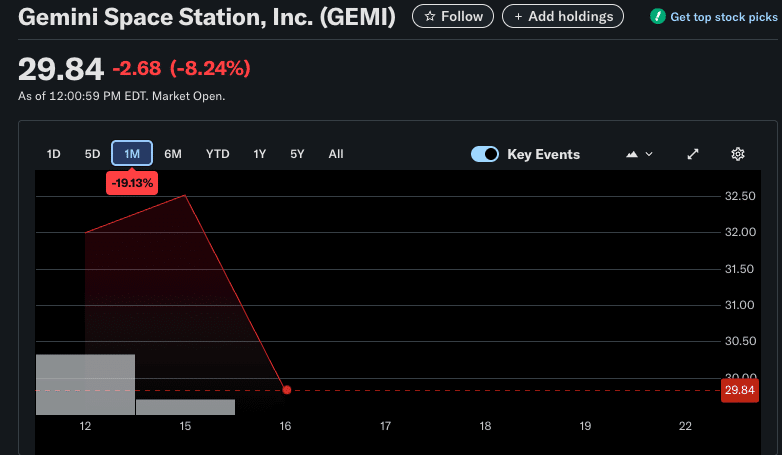

The stock, which trades on the Nasdaq exchange, closed down approximately 6% on Tuesday at $30.42. After its IPO priced at $28 per share last Friday, Gemini’s stock initially surged to a high of $45.89 on its first day of trading. However, the early gains have since evaporated, with the stock plunging more than 34% from its peak as market sentiment has cooled.

The drop seems to be related to investors’ worries that the company isn’t making enough money. Gemini filed for an initial public offering (IPO) and said it had a net loss of $283 million for the first half of 2025. This was after losing $159 million for the whole year of 2024. The exchange was worth $3.3 billion before trading, which is a big difference in results.

Ed Engel, an analyst at Compass Point, highlighted the valuation challenge, noting that “GEMI is currently trading at 26 times its annualized first-half revenue,” a steep multiple for a loss-making company. Gemini’s slump comes as competitors have seen mixed results over the past week; shares of Coinbase (COIN) remained flat and Robinhood (HOOD) fell 3%, while Circle (CRCL) saw its stock rise 13%.

While Gemini successfully raised $425 million from its public offering, its subsequent market performance underscores the intense scrutiny that crypto-native firms face on Wall Street. The swift downturn suggests that investors are increasingly prioritizing a clear path to profitability over brand recognition and growth projections alone.

Gemini’s experience may serve as a cautionary tale for other crypto companies considering an IPO, indicating that public markets demand sustainable financial models, even from the most established digital asset brands.

Also Read: SEC, Gemini Reach Tentative Settlement in Crypto Lending Case

Disclaimer: The Crypto Times publishes news, analysis, and educational content for informational purposes only. We do not offer financial, investment, legal, or trading advice of any kind. All content on our website is intended to be neutral and fact-based. Readers should always do their own research, consult with licensed professionals, and evaluate risks independently.