Stocks and crypto are finally catching a break after weeks of losses. February was a rough ride, filled with uncertainty and sharp declines, but Friday’s rally gave investors a much-needed sigh of relief.

The U.S. stock market had a wild session, dipping early in the day after a tense moment between President Donald Trump and Ukrainian President Volodymyr Zelenskyy at the White House. The two leaders clashed over a potential mineral rights deal, briefly shaking investor confidence.

But by the end of the trading day, markets had recovered, with the S&P 500 climbing 1.59% to 5,954.50. The Dow Jones surged 601.41 points, or 1.39%, to close at 43,840.91, while the Nasdaq gained 1.63% to settle at 18,847.28.

Even with Friday’s strong comeback, February was still a rough month overall. The Nasdaq took a big hit, falling nearly 4%, its worst month since April 2024. The S&P 500 and Dow didn’t fare much better, slipping 1.4% and 1.6%, respectively.

A combination of economic worries, rising trade tensions, and a rough stretch for tech stocks, particularly Nvidia, kept investors on edge and dragged markets lower.

The crypto market is finally catching a break too. Ethereum rose 6.09% to $2,256.64, with a market cap of $270.28 billion, and its 24-hour trading volume values at $25.82 billion, dropping almost 20%.

While XRP pumped 9.31% to $2.20, with its market cap valued at $126.29 billion and the 24-hour trading volume valued at $6.28 billion, dropping 6.57%.

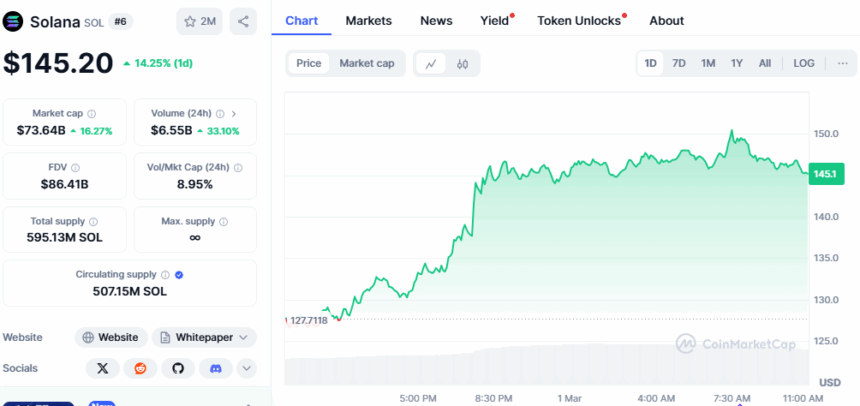

Solana was the biggest winner of the day, surging 14.47% to hit $145.25. The 24-hour trading volume is currently valued at $6.55 billion, surging 33%, and its market cap is valued at $73.64 billion.

Overall, the crypto market’s total value increased by 7.19% to $2.84 trillion, with an enormous $150 billion traded in just 24 hours. However, DeFi activity remains a small player, accounting for only 5% of that volume.

Part of the reason for the stock market’s late rally was technical factors, like index adjustments and big investors making strategic moves, which helped lift prices. Traders who had been nervous about market instability seem to be gaining some confidence, at least for now. The real question is whether this rebound will last or if it’s just a temporary bounce before another downturn.

Crypto, as usual, is moving in sync with stocks. That doesn’t mean we’re in the clear just yet. The economy is still shaky, and regulatory surprises could shake things up again. No one can say for sure if this recovery will last or if it’s just a temporary bounce.

Also Read: Crypto Flooded with Zelensky Memecoins After Trump Clash