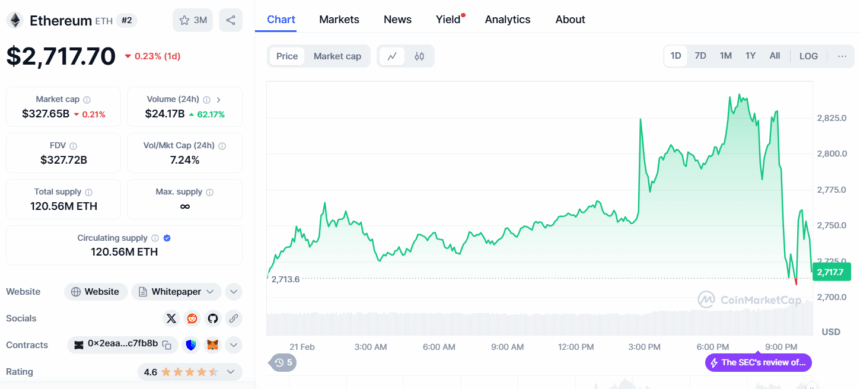

Crypto Exchange hacks and fear goes hand in hand, following the confirmation of the $1.5 Billion bybit hack the Ethereum price took a nose dive. As the trading volume has increased by 62% it can be considers that investors are fearing an ETH sell off.

As per the data of CoinMarkletCap, the Ethereum price has been dropped from $2,850 to $2,750 within an hour after the reports of Bybit came out.

The hack was confirmed by Bybit CEO Ben Zhou, who stated that attackers exploited a multisig cold wallet using a deceptive interface, stealing ETH and stETH. Over 400,000 ETH have been moved, with $200 million stETH already sold.

The sudden price drop was accompanied by around 60% surge in 24-hour trading volume, reaching $24.73 billion, as investors rushed to react. The sell-off intensified as stolen funds began moving to new addresses and being sold on decentralized exchanges.

With uncertainty surrounding Bybit’s response and potential further liquidations, traders remain on edge, fearing additional declines in Ethereum and the broader crypto market.

Also Read: Bybit Hack of $1.5 Billion: Is WazirX users’ money safe?