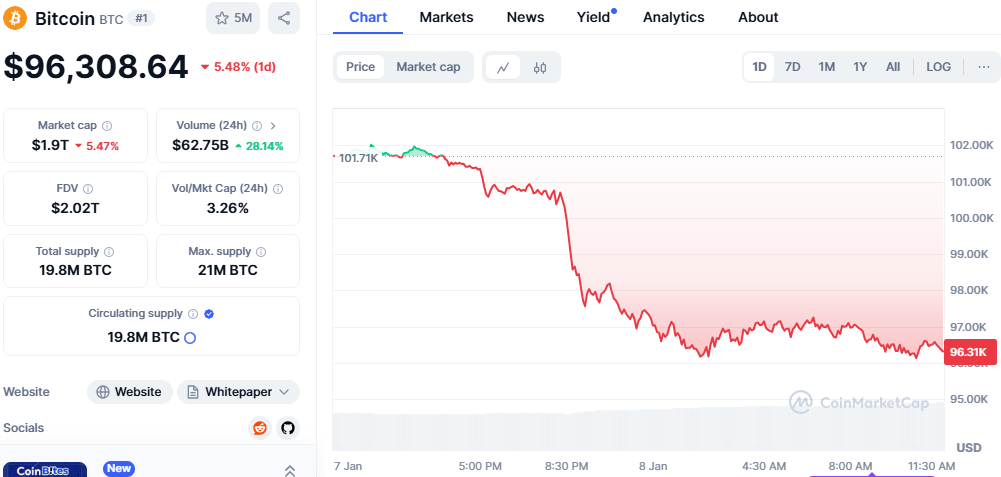

The cryptocurrency market witnessed a sharp decline in the past 24 hours, with Bitcoin (BTC) dropping 5.48% to $96,308.64. Bitcoin’s market cap now stands at $1.91 trillion, while trading volume surged to $62.75 billion, up 28.14%.

Altcoins, however, bore the brunt of the sell-off, with significant losses across the board. Hyperliquid (HYPE) led the altcoin slump, plummeting 15.29% to $21.62. Once a high-flyer with a 60% gain in the past month, HYPE has been on a consistent downward trend, losing 10.24% over the last week alone.

Celestia (TIA) also dropped 14.71%, now trading at $4.66, with a market cap of $2.24 billion. Ethena (ENA) fell 13.65% to $0.9913, while the decentralized exchange token dYdX (DYDX) declined 13.49% to $1.40. Meme coin Bonk (BONK) slid 13.29% to $0.00002976.

The 24-hour liquidations highlighted the extent of the market turbulence. Over 204,000 traders were liquidated, resulting in $626.85 million in losses. The largest single liquidation involved $17.74 million worth of ETHUSDT on Binance.

Bitcoin accounted for $110.89 million in liquidations, with $98.6 million from long positions and $12.19 million from shorts. Altcoins contributed significantly to the $565.68 million long liquidations, compared to $61.22 million in shorts.

Experts attribute the sell-off to over-leveraged positions and profit-taking after recent rallies, especially in altcoins like Hyperliquid, which had surged dramatically. The spike in trading volumes indicates panic among traders.

Analysts caution that while this correction may provide buying opportunities, the market remains highly volatile. The current dip emphasizes the importance of managing risk and diversifying portfolios, they suggest, advising traders to stay vigilant.

Also Read: Bitcoin Dips Below $98K as Strong U.S. Data Triggers Liquidations