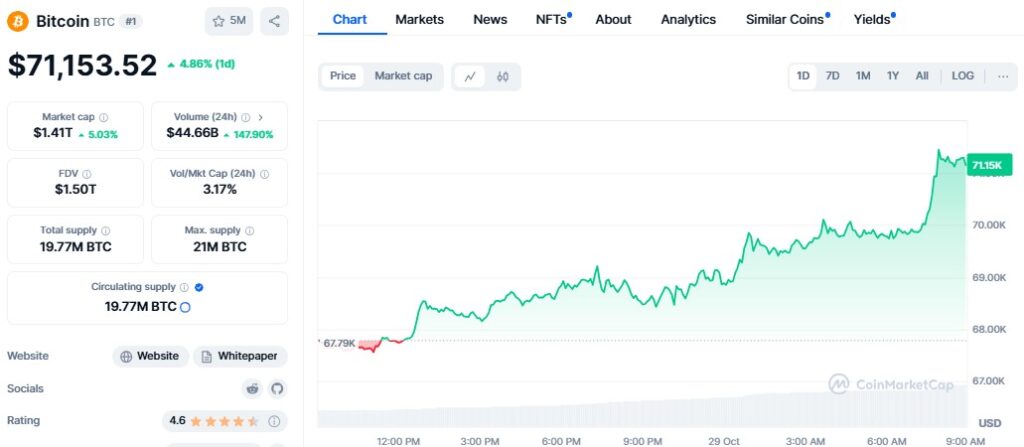

Bitcoin price soared above $71,000 early Tuesday, leading a broader rally in the cryptocurrency market. This surge comes just a week before the U.S. elections, which many traders believe could act as a positive catalyst for Bitcoin, regardless of the election outcome.

Over the past 24 hours, Bitcoin gained 5%, breaking through the important $70,000 resistance level with trading volumes reaching $44.66 billion, nearly double Monday’s figures.

This spike led to the liquidation of more than $176 million in short positions, meaning many traders betting against Bitcoin were forced to close their losing bets. In particular, Bitcoin shorts lost around $88.89 million, while Ethereum (ETH) shorts lost about $39.73 million.

Analysts suggest that much of the buying interest is coming from large traders, known as whales, particularly on Binance during Asian trading hours. Additionally, Bitcoin exchange-traded funds (ETFs) have added to the demand, with a net inflow of 47,000 BTC in the last two weeks.

Other cryptocurrencies also saw gains, with Dogecoin (DOGE) jumping 15% and Shiba Inu (SHIB) rising 8%. Ethereum climbed 4.9%, while Cardano (ADA), Solana (SOL), and BNB Chain (BNB) each increased by over 3%.

As the November elections approach, traders are betting on Bitcoin reaching new highs, with many focusing on the $75,000 strike price for options expiring soon. Whether a Republican or Democrat wins, many believe Bitcoin’s future remains bright.

Also Read: Trump vs. Harris: Can Bitcoin Hit $100k by the End of 2024?