The cryptocurrency market offers great financial opportunities to its community and various investors worldwide, however, its decentralised and non-regulated nature exposes them to risks such as scams, rug pulls, and market manipulations.

One such scandal revolving around high-profile Argentina President Javier Milei’s X (formerly Twitter) post about LIBRA cryptocurrency shook the industry and created chaos in the market.

A judge in Argentina has been selected to investigate allegations of fraud against President Javier Milei for his brief promotion of a LIBRA token, which collapsed in value hours after its launch. Milei has denied the claims that he promoted the controversial LIBRA token, which quickly lost 97% of its value, sparking multiple fraud suits and calls for his impeachment.

Moreover, the prominent crypto influencers and analysts point out that LIBRA had no clear roadmap, no development team, and no whitepaper, which is a sign of a classic meme coin scam.

In this article, we will understand about the LIBRA scandal in detail, the controversy behind it and who lost and who gained. We will also learn about the involvement of potential insiders and the ongoing legal investigation.

Who launched LIBRA Token?

The LIBRA token was created by entrepreneur Hayden Davis, who is also the CEO of Kelsier Ventures, a cryptocurrency investment firm. On February 14, the token was launched on Solana (SOL) blockchain and available to purchase through the website “vivalalibertadproject.com,” a well-known phrase that Milei uses to close speeches and messages on his social media.

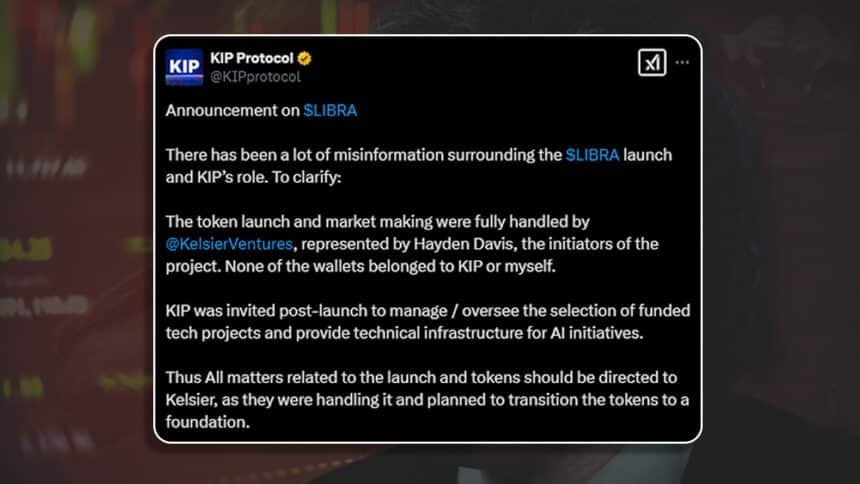

According to some reports, KIP Protocol, focused on decentralised AI technology, has played an important role in the launch of the LIBRA token. The company claims that they participated after the launch to help to select technology and support AI efforts.

LIBRA Memecoin Controversy

The controversy erupted in mid-February, 2025, when Argentina President Javier Milei announced the crypto token. Later, he deleted his X post that the LIBRA token would boost Argentina’s economy and support small businesses. He stated, “I was not aware of the details of the project and after having become aware of it I decided not to continue spreading it.”

When Milei publicly posted about the project, the crypto market took immediate notice. Many traders saw this as an official endorsement from the Argentina government which caused a buying spree. LIBRA’s value climbed, going from just a few cents to over $4.50 within hours, with market cap surging past $4.5 billion, making it one of the fastest-growing meme coins in recent history.

He withdrew his support after its price spiked several hundred within hours. This action by Milei sent shockwaves throughout the market which triggered widespread panic among investors and sparked token sell-offs.

When Milei deleted the tweet, at the same time, the team behind the token KIP Protocol also emphasized that LIBRA is not associated with Milei. This statement caused the market cap of LIBRA to drop to $130 million dollars, a decline of up to 97%.

Also, KIP Protocol clarified that “The token launch and market making were fully handled by Kelsie Ventures, represented by Hayden Davis, the initiators of the project. None of the wallets belonged to KIP or myself. KIP was invited post-launch to manage/oversee the selection of funded tech projects and provide technical infrastructure for AI initiatives.”

“Thus, all matters related to the launch and tokens should be directed to Kelsier, as they were handling it and planned to transition the tokens to a foundation,” he added.

After this incident, many experts suspected that insiders had already cashed out, profiting from the massive surge while retail investors were left holding worthless tokens. Blockchain data analysts confirmed that several large wallets had dumped their LIBRA holdings just before the crash, which further fuelled allegations of a pump-and-dump case. Investors are furious, demanding answers and calling for government intervention.

Who Lost Money?

The biggest victims of the LIBRA scandal were the retail investors who bought because of the hype, believing it as a government-backed initiative and considering it an authentic token. According to some reports, around 74,000 users collectively lost approximately $286 million. Among them, 24 traders lost more than $1 million, and 61 traders lost more than $500k, based on transaction history.

- The biggest loss was around $5.17 million. He spent $5.6 million to buy 2.1 million tokens in total and sold these tokens for just $430k.

- A trader identified as “62KQa” purchased 659,000 LIBRA tokens for $2.5 million. He later sold all of them for just $392,000, making a huge loss of $2.1 million.

- Several small investors from Argentina reported losing their entire life savings after investing in LIBRA.

Crypto influencers who supported and encouraged the token without doing proper research also experienced reputational damage, with many being called out for misleading their audiences.

Who Made Money?

While thousands suffered losses, some few have earned handsome returns. On-chain data analytics platform, Lookonchain, has found out that a total of 8 wallets relating to the LIBRA team have benefited the most- about $107 million by adding and removing liquidity as well as claiming fees. The funds include $57.6 million of USDC and $49.7 million of SOL.

Additionally, experienced crypto traders who understood the “pump-and-dump” mechanics of meme coins managed to capitalize on the early hype:

- As per reports, Hayden Davis at Coffeezilla has admitted that he had made around $113 million in total through LIBRA token. However, he clarified that it is not a fraud but a failed token strategy.

- A group of whales (large investors) reportedly cashed out over $25 million in the first few hours.

- Crypto insiders, familiar with meme coin scam culture, shorted their tokens, thereby making money when it collapsed.

Argentina Judge to Investigate Milei Crypto Scandal

As outrage grew, Milei is facing investigation for endorsing the controversial LIBRA token that crashed hours after its launch. Milei and his office denied involvement with creators of the $LIBRA cryptocurrency, saying he initially drew attention to it last week as an entrepreneurial project that might benefit Argentina but learned more about it later and then withdrew his support.

On February 17, the case was assigned to Judge Maria Servini, head of Federal Court No. 1 in Buenos Aires.

The key points of the investigation will include:

- Potential insider trading and market manipulation

- Whether President Milei had direct involvement in the LIBRA scam

- Tracing wallets that made significant gains from the token’s downfall

Further, Argentina’s anti-corruption department is also analyzing whether President Milei’s deleted post on X shows misuse of political influence for financial gain.

Probes and Political Fallout

The LIBRA crypto scandal in Argentina has escalated, with various ongoing investigations and legal actions. In March, Argentine lawyer Gregorio Dalbon requested an Interpol Red Notice for Hayden Davis, citing his role in the collapse that caused $250 million in investor losses.

Argentina’s Chamber of Deputies established a special committee in April to probe potential connections with President Javier Milei, summoning top officials like Economy Minister Luis Caputo.

There are also lawsuits filed in the U.S. and Spain, accusing Milei and associated companies of fraud and market manipulation. Blockchain analysis revealed that insiders connected to LIBRA withdrew $99 million, fueling pump-and-dump allegations. With all these legal scuffles, the LIBRA scandal continues to damage Argentina’s crypto reputation and Milei’s presidency.

LIBRA Creators tied to other Memecoins

On-chain evidence showed connections between LIBRA’s creators and lately introduced meme coins. Blockchain analytics have identified that there are some wallets which are involved in the LIBRA scam that were previously linked to the meme coins, launched by the U.S. President Donald Trump (TRUMP) and his wife Melania Trump (MELANIA). Both the coins have gone through a similar pump-and-dump journey in 2024.

These findings have intensified the inspection in LIBRA scandal case and possibility of insider involvement in directing fraudulent activities across multiple cryptocurrency projects.

Conclusion

The LIBRA token scandal marks a pivotal peak in the meme coin craze, underscoring the necessity for more robust risk management measures on launchpad platforms. It seems that Milei’s influence played a direct role in attracting investors, raising ethical concerns about public officials endorsing speculative financial products.

The scam has not only led to substantial financial losses for many but has also sparked legal and political turmoil in Argentina. As the investigation proceeds, the outcomes may have lasting repercussions with regards to cryptocurrency regulations across the globe.

Also Read: 80% crypto investors bought TRUMP, LIBRA memecoins: New Study