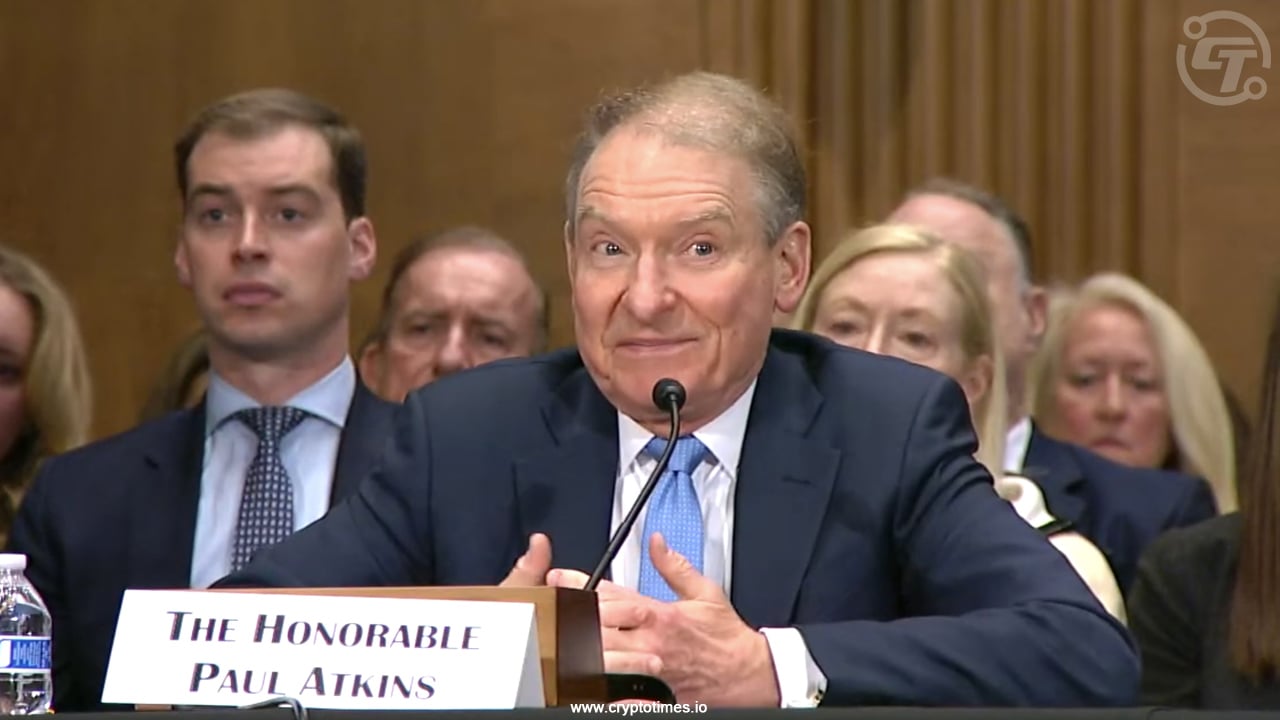

On September 10, Chairman Paul S. Atkins of the U.S. Securities and Exchange Commission (SEC) stated that the SEC would be starting a new, more innovative set of rules for digital assets.

During his speech at the first OECD Roundtable on Global Financial Markets in Paris, Atkins introduced “Project Crypto,” a broad plan to set clear rules for the business and stop the agency from relying on “ad hoc enforcement.”

This policy shift aligns with a direct mandate from the White House. “President Trump has tasked me and my counterparts across the Administration with making America the crypto capital of the world,” Atkins stated, referencing a recent report from the President’s Working Group on Digital Asset Markets.

Atkins added that the SEC’s new philosophy is to provide the “minimum effective dose of regulation needed to protect investors, and no more,” quoting Victor Hugo to emphasize that “crypto’s time has come.”

A Clear Framework for Innovation

Under “Project Crypto,” the SEC will prioritize several key areas to modernize securities rules for on-chain markets. A primary goal is to provide certainty on the legal status of digital assets. “Most crypto tokens are not securities, and we will draw the lines clearly,” Atkins explained in his speech.

The initiative also aims to streamline regulations for crypto platforms, allowing for “‘super-app’ trading platform innovation that increases choice for market participants.” This would permit platforms to offer trading, lending, and staking services under a single, cohesive regulatory umbrella. The chairman also signaled a potential review of standards for foreign companies listed in the U.S., referencing a concept release issued in June.

This statement is a big change from how the SEC used to handle digital assets, which was mainly through enforcement. It opens a new era of regulatory clarity and support for the crypto industry in the US For years, market participants have called for clear rules of the road, and this new agenda aims to deliver just that.

By fostering an environment conducive to innovation in both crypto and artificial intelligence, the SEC’s new leadership intends to spark a “golden age of financial innovation on U.S. soil,” positioning the nation to compete directly with other global crypto hubs and potentially setting a new standard for digital asset regulation worldwide.

Also Read: SEC and Nasdaq Tighten Rules Amid Chinese IPO Fraud Fears