Key Highlights:

- Derivatives Traders are shifting their focus away from BTC and ETH to XRP.

- The past 72 hours have been marked by a wave of risk reduction and de-leveraging across BTC and ETH.

- The Open Interest accumulation on XRP aligns with renewed speculation about Spot XRP ETFs.

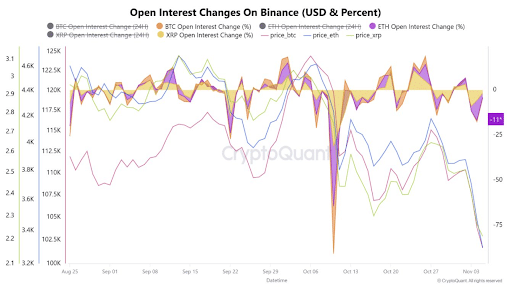

As derivatives traders on Binance unwind positions in the major cryptocurrencies Bitcoin (BTC) and Ethereum (ETH), open‐interest data from CryptoQuant reveals a shift into XRP. This signals that traders are now placing bets on XRP even amid the broader market correction.

In a rotation, traders are reducing their exposure to BTC and ETH futures while simultaneously accumulating bullish positions in XRP, indicating a shift toward the altcoin.

According to CoinMarketCap data, BTC is trading at $101,404 with a 2.44% decline in the past 24 hours. Similarly, ETH has declined 3.56% over 24 hours, currently trading at $3,356. Surprisingly, XRP is down by 2.38% in the last 24 hours, trading at $2.22 at the time of writing.

BTC and ETH open interest decline

The past 72 hours have been marked by a wave of risk reduction and de-leveraging across the two largest cryptocurrencies. Bitcoin futures have seen a net reduction in Open Interest (OI). The trend began with a drop of -$957.43 million, showing a -0.89% decrease, followed by a further reduction of -$59.87 million (-0.56%).

The exodus from Ethereum futures has been even more pronounced. Following a -$783.52 million (-11.04%) plunge, the latest data showed a decline of -$148.69 million (-2.36%) in Open Interest, showing a de-leveraging event and moving away from ETH futures contracts.

Open interest reflects the total number of derivative contracts—when OI rises, it typically suggests fresh capital or increased leverage entering the market; when it falls, it signals contraction or de-risking. In recent sessions, both BTC and ETH OI have seen steep declines (nearly $1 billion over two days), while XRP’s OI is bucking the trend.

XRP as the outlier

Defying the market trend, XRP is showing signs of bullish accumulation. However, the asset saw a minor pullback of -$8.69 million (-1.71%) in Open Interest over the past 24 hours, following a previous reduction of -$30.89 million (-5.73%).

Analysts note that traders appear to be using these slight dips to add new positions. This conviction in XRP futures contracts stands in contrast to the fear and risk aversion gripping the BTC and ETH markets, demonstrating a bullish bet on the altcoin. This divergence shows a rotation in capital, suggesting that the trading community sees greater upside potential in XRP compared to the leading cryptocurrencies, which are currently undergoing a period of de-leveraging.

Reason behind OI accumulation

The Open Interest accumulation on XRP aligns with renewed speculation about Spot XRP Exchange-Traded Funds (ETFs). There has been discussion and even fee disclosures from firms like Bitwise and Grayscale, along with Franklin Templeton, for proposed XRP ETFs.

Bloomberg ETF analyst James Seyffart wrote on X, “They’re looking to launch this month.”

Another reason why XRP is benefiting is from a clearer regulatory context, i.e., Ripple Labs finally ended the lawsuit with the SEC after 5 years of legal battle, as the court approved dismissal.

The expectation is that a spot ETF approval would open the floodgates for institutional capital, a long-term bullish catalyst. Traders piling into XRP futures are essentially front-running this potential institutional adoption.

Implications for market outlook

If XRP OI continues to rise while BTC and ETH OI remain weak, it could signal a meaningful capital shift within the crypto landscape, from large-cap “anchor” assets toward mid-cap or altcoins seeking next-leg upside.

For traders, this might imply two tactical approaches—monitoring the OI spread between major tokens to detect early rotation and incorporating XRP-specific risk metrics (funding rates, exchange flows, and regulatory updates) into positioning decisions.

The trend shows how derivatives sentiment can serve as an indicator of market rotation.

Risks and considerations

While OI in XRP is currently increasing, future OI declines in BTC/ETH may reflect risk-off sentiment across crypto more broadly, meaning the rotation may not necessarily signal bullishness but rather repositioning.

Furthermore, a past episode in mid-October saw XRP’s total OI across exchanges plunge from about $2.9 billion to $1 billion within 12 days, a 65% collapse, showing how quickly the derivatives backdrop can unwind.

Lastly, even though accumulation signals (such as exchange outflows) are present, they do not guarantee price momentum. It depends on broader liquidity, macro tailwinds, and network fundamentals.