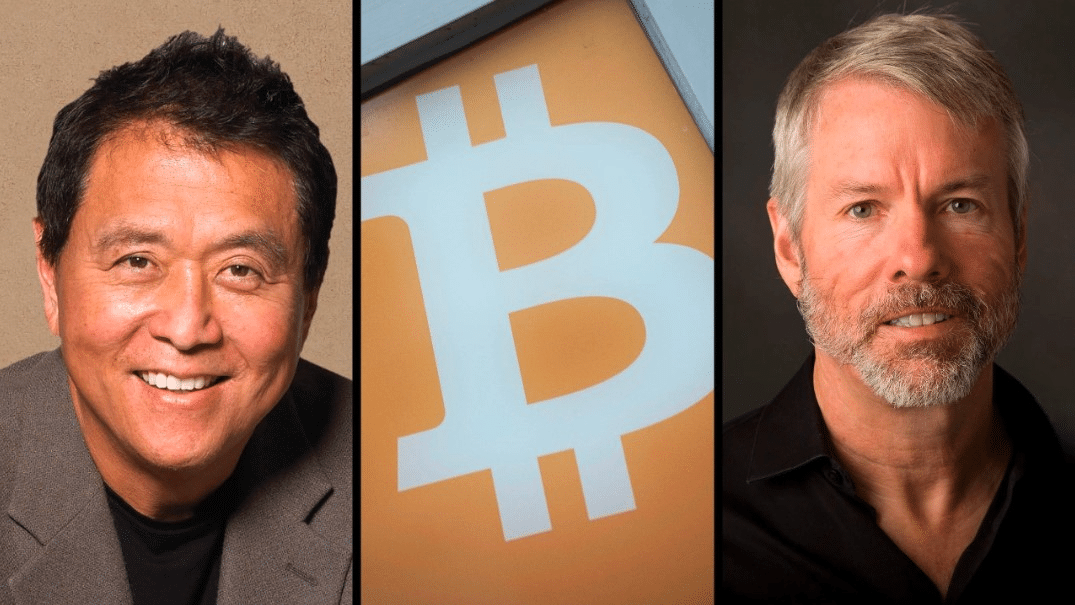

Bitcoin’s biggest believers, Strategy’s Michael Saylor and Rich Dad Poor Dad author Robert Kiyosaki, are doubling down on their bullish bets. Both predict the world’s largest cryptocurrency could soar to new heights, with targets between $150,000 and $200,000 by the end of 2025.

At the time of writing, Bitcoin is currently trading between $110,500 and $111,000, retreating from its record high of $126,183 earlier this month. The pullback came after a huge liquidation process on October 10 that rocked the crypto market to the tune of $19 billion.

Long-term Bitcoin believers, such as Saylor and Kiyosaki, are optimistic that the next leg of the Bitcoin bull run is only starting despite the dip.

Michael Saylor’s $150,000 forecast

Speaking on CNBC, Strategy Executive Chairman Michael Saylor said Bitcoin’s “growth cycle remains intact,” even after recent corrections. He expects BTC to hit $150,000 by the end of 2025, citing increasing market maturity and reduced volatility.

“I think Bitcoin’s going to continue to grind up,” Saylor said. “Our expectation right now is that by the end of the year, it should be about $150,000.” Saylor also shared a bold long-term view, predicting Bitcoin could rise 30% annually for the next 20 years, reaching $20 million per coin someday.

His optimism is backed by MicroStrategy’s consistent buying spree. The company recently added 390 BTC worth $43.4 million, bringing its total holdings to 640,808 BTC.

Robert Kiyosaki predicts $200,000 Bitcoin

Meanwhile, Robert Kiyosaki posted on X (formerly Twitter) that he holds “millions in Bitcoin” and expects prices to reach $200,000 by year-end. He urged investors not to be scared when the market, saying, “Losers are more afraid of losing than getting rich.”

His message struck a chord with retail traders facing a volatile market. Kiyosaki framed emotional control as the key to long-term success in crypto investing.

Why This Matters

Both the predictions of Saylor and Kiyosaki point to renewed trust in the long-term development of Bitcoin despite the fluctuations in the short run.

The current dip is also seen by analysts as a mid-cycle correction and not the end of the bull run and this means that the next wave of gains may be nearer than many may think.

Also Read: Bitcoin May Never Fall Below $100,000 Again: Standard Chartered