The U.S. Securities and Exchange Commission (SEC) has given the go-ahead for the Grayscale Solana Trust ETF to trade on the NYSE Arca exchange. This means big investors and financial firms can now invest in Solana through a fully regulated product.

According to Grayscale’s submission, the new exchange-traded fund (ETF) will give U.S. investors their first chance to invest in Solana through an officially regulated product. The launch comes at a time when the SEC is still running with limited staff because of the ongoing government shutdown.

Despite this, the agency authorized new listing standards that allow commodity-based trust shares—like Solana’s ETF—to move forward under streamlined procedures. Consequently, several crypto ETFs, including those for Hedera and Litecoin, began trading this week.

Institutional momentum builds for Solana

The approval triggered strong reactions across the crypto industry. “Solana just got its Wall Street stamp,” said Vince Crypto on X. “The suits are officially buying what degens were aping into years ago.” The statement captured the market’s sentiment as investors shifted focus beyond Bitcoin and Ethereum.

Bloomberg Intelligence analyst James Seyffart projected that Solana’s ETF could attract over $3 billion in its first 12 to 18 months. “A good frame of reference is to look at Solana’s size relative to Bitcoin and Ethereum,” he noted. Bitwise’s Solana ETF (BSOL) traded $10 million within its first 30 minutes, while Hedera’s HBR and Litecoin’s LTCC posted strong debuts on Nasdaq.

Broader institutional adoption expands

Beyond ETFs, Solana is also getting strong backing from major global players. Western Union announced on October 28 plans to launch its own U.S. dollar-backed stablecoin, called USDPT, on the Solana blockchain. Built in partnership with Anchorage Digital Bank, the new token will be used to send money across more than 200 countries, making international transfers faster and cheaper.

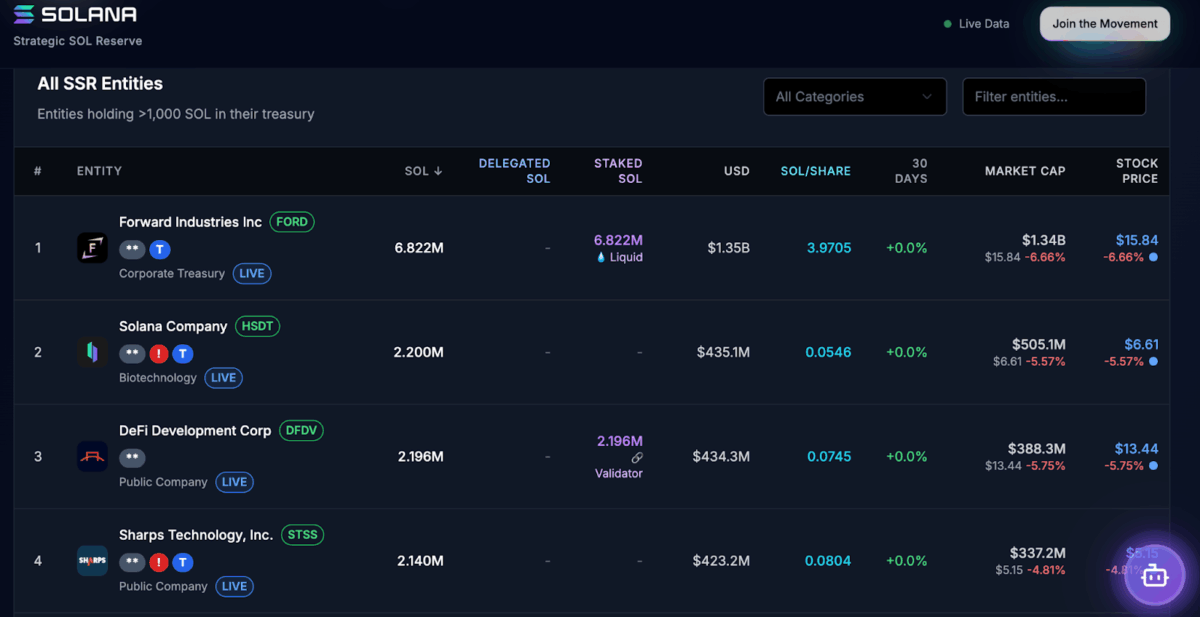

Data from the Solana Strategic SOL Reserve shows that Forward Industries holds the biggest stash of Solana, with 6.82 million SOL valued at about $1.35 billion. It’s followed by Solana Company, DeFi Development Corp, and Sharps Technology Inc., each holding more than 2 million SOL. While the companies’ stock prices have dipped slightly, the pullback is part of a wider market correction and not a sign of weakness in Solana itself.

Solana’s ETF approval shows that traditional finance is finally taking it seriously. Grayscale’s move signals that Solana is no longer just a crypto favorite—it’s becoming a core asset in mainstream investing.

Also Read: Wintermute Predicts Cleaner Positioning to Lift Crypto in November