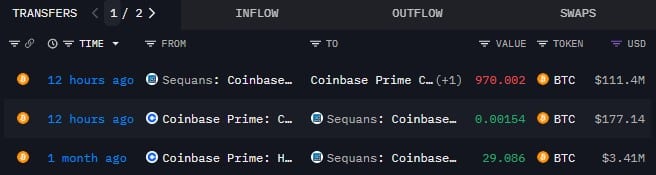

Sequans, a Bitcoin treasury company, has transferred 970 BTC worth about $111 million to Coinbase, marking its first major outbound transaction since adopting its Bitcoin treasury strategy.

The move immediately drew the attention of traders, with the large transfers to exchanges usually leading to questions about possible selling or reallocation.

On-chain data revealed that Sequans made a major deal with Coinbase, one of the largest crypto exchanges in the U.S. This is the first massive outbound transfer of the company since it started amassing Bitcoin.

After the transfer, Sequans still holds around 2,264 BTC, valued at approximately $255.75 million, a sizable reserve that keeps it deeply exposed to Bitcoin’s price movements.

Why It matters

Large Bitcoin transactions by corporate treasuries can be the subject of a discussion on whether a company is about to sell or is just restructuring its assets. In the case of Sequans, there has been no official statement that can be made and speculation can be done.

Institutions usually use Over-the-counter (OTC) desks to sell large volumes to prevent slippage, and Coinbase Prime provides custody and treasury products, indicating that the relocation may be more about storage, rather than selling.

Market context

So far, the market has not experienced any significant disruption after the transfer. Exchange reserve data and inflow metrics will likely reveal more in the coming days.

At the time of writing, Bitcoin is $112,571, and the 24-hour trading volume is $6.6 billion. The cryptocurrency is down 1.12% in the last 24 hours, holding a live market cap of $2.24 trillion, according to CoinMarketCap.

Sequans’ move highlights how corporate Bitcoin treasuries are evolving. Like Strategy, Tesla, and Block, the company is still influencing the trend of storing value in Bitcoin as a long-term store of value.

Also Read: Strategy Adds 390 BTC, Holding Now 640,808