Lighter, a crypto platform for perpetual futures, has seen a big jump in daily trading, beating Aster and Hyperliquid over the past three days. On October 26, it handled $8.6 billion in trades, though the total value of open positions was $1.7 billion, still below its competitors.

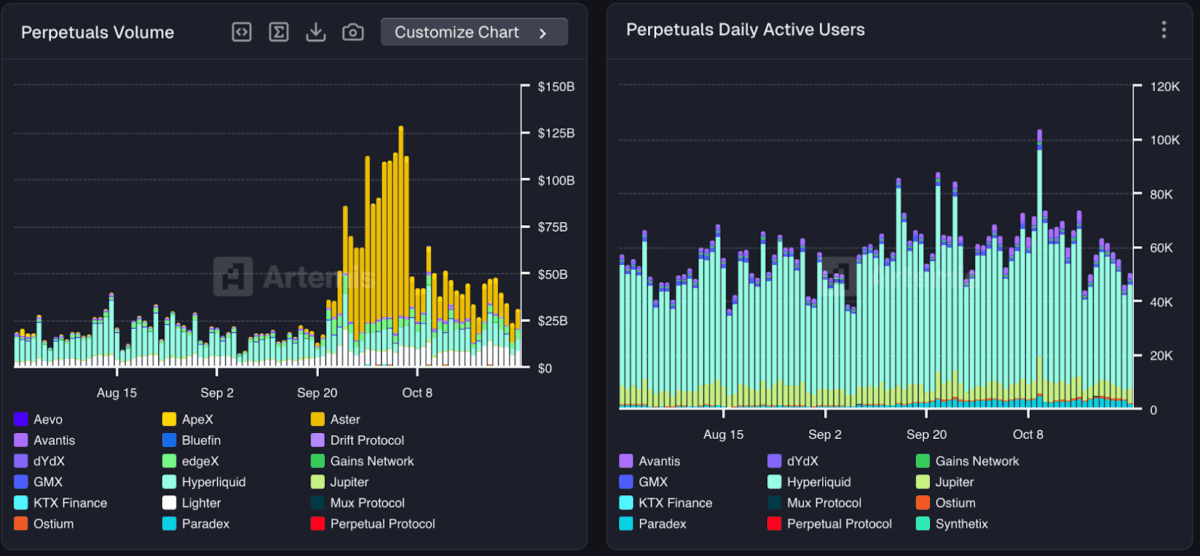

According to data from Artemis, perpetual trading picked up sharply in late September, briefly climbing above $125 billion, mostly fueled by strong activity from the ApeX and Aster platforms. However, after early October, daily totals eased to $25–50 billion, stabilizing trading activity.

Besides volume fluctuations, daily active users remained consistent, with platforms like Hyperliquid, Paradex, and dYdX attracting 40,000–80,000 users per day.

Lighter runs on Ethereum using zk-rollup technology, which makes it faster and cheaper to trade perpetual futures. Its recent growth shows traders are still active, even though the overall crypto market has become less volatile.

Open interest trends and market dynamics

Open interest, a measure of how much capital is locked into open perpetual futures trades, increased during September and peaked almost to $30 billion at the beginning of last month. Hyperliquid took the biggest share, though ApeX, Aster, and dYdX also gained strongly in that peak.

However, after early-October highs, open interest normalized around $15–20 billion. Hence, even as Lighter leads daily volume, its smaller open interest suggests new participants or higher turnover, rather than long-term leveraged positions dominating the market.

On October 27, Astros launched its perpetual DEX on the Sui network, which now holds $2.6 billion in total value. “Perp DEXs have become the ultimate litmus test for a blockchain’s ability to handle real financial infrastructure,” said Jerry Liu, Astros Founder.

Yesterday, Surf Protocol introduced TurboFlow, a fully on-chain trading platform that allows traders to use leverage of up to 1000x. It includes both traditional fee models and a fee-free profit-sharing option.

These shifts show how much perpetual futures have grown in crypto, now making up 26% of all derivatives trading and reaching around $1 trillion in monthly volume.

Lighter’s rise in daily trading shows more traders are joining, even if long-term positions stay small. The perpetual futures market keeps growing, and fast, low-cost platforms on new chains are driving DeFi forward.

Also Read: Coinbase Partners With Citi to Advance Blockchain Payments