Bitcoin bounced back above $115,000 on Sunday night, bringing fresh optimism to the crypto market. At the moment, it is trading around $115,218, with daily trading activity hitting $47.6 billion—a 3.41% jump in just 24 hours.

The overall crypto market cap has also grown to $3.9 trillion, up 3.68% today, while overall trading volumes have spiked by 68.41% to $139.39 billion.

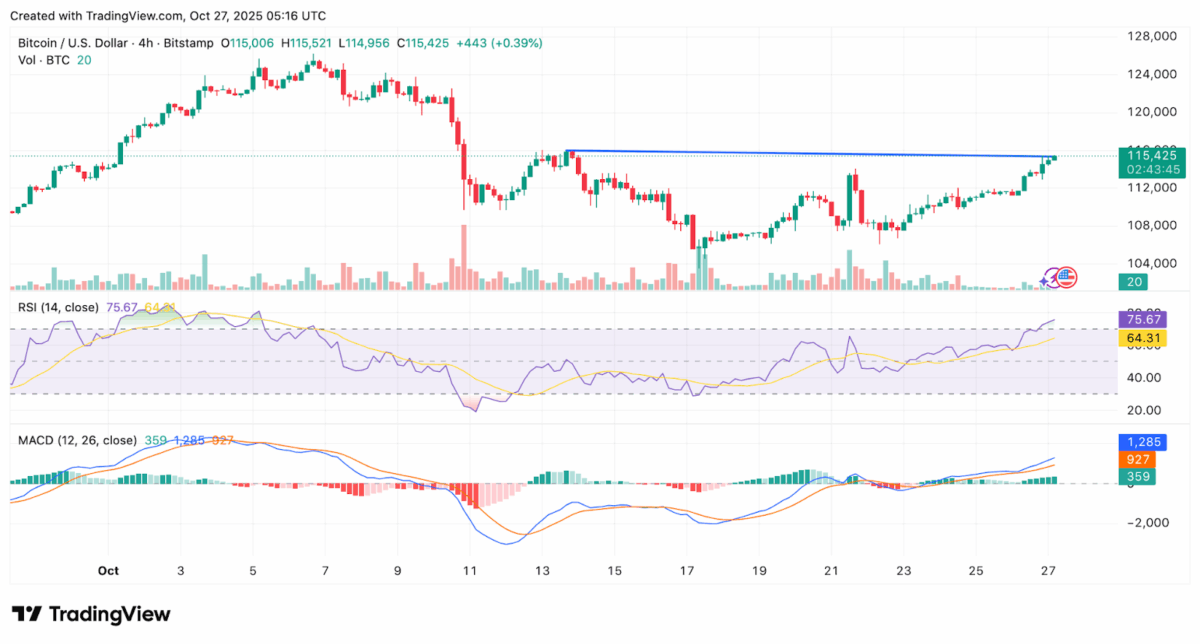

According to TradingView data, Bitcoin’s 4-hour chart shows the price approaching a resistance level near $115,400. This level has acted as a ceiling several times before, creating anticipation for a potential breakout.

Also, the RSI value of 75.67 suggests Bitcoin may be slightly overbought with strong demand. Aside from that, the MACD indicator remains positive, which means short-term momentum remains in the bulls’ favor.

Analysts expect volatility ahead

Market analyst Daan Crypto Trades noted, “Sentiment was bearish going into September which ended up green. Sentiment was bullish going into October which is red as we speak. Meanwhile, Bitcoin’s price has opened & closed within a small 8% price range during the past 4 months. A bigger move is coming at some point.” He predicts stronger volatility heading into the end of 2025.

Similarly, analyst Crypto Caesar stated, “$BTC – bitcoinbuilder is testing a key resistance around $112K. A CLEAN break and close above it could confirm a bullish continuation toward $123K.”

Additionally, trader Astronomer highlighted that Bitcoin longs from $107K remain open with targets near $118K, but noted the likelihood of a CME gap closing before further upside.

Market overview

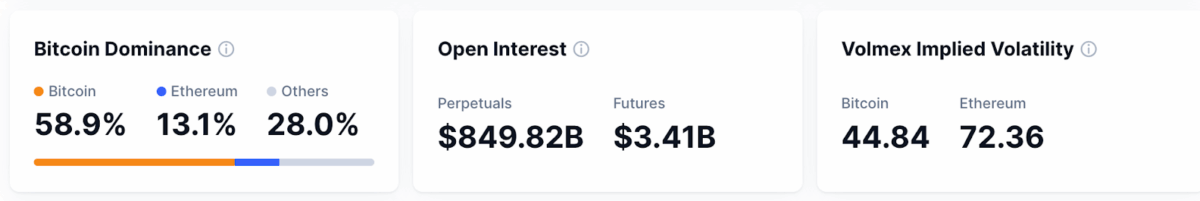

According to CoinMarketCap data, the Fear and Greed Index is 42, which means the market is neutral. Bitcoin is still leading the market with 58.9%, followed by Ethereum with 13.1%. The Altcoin Season Index is 30, meaning it is still very much Bitcoin’s time to shine.

In the meantime, trading activity on cryptocurrency derivatives remains high, with $849.82 billion in perpetual contracts and $3.41 billion in futures that have not been settled. Some of the leading altcoins have also jumped more than 10% in the past 24 hours, including Bitcoin Cash (BCH), Zcash (ZEC), and Uniswap (UNI).

Bitcoin’s climb past $115K indicates that buyers are confident again and the market has regained fresh energy. Still, traders are staying cautious because bigger price swings could be coming before the year ends.

Also Read: Indian Court Rules Crypto is Property Capable of Ownership and Trust