Binance’s native cryptocurrency, BNB, is now live for trading on Robinhood and Coinbase after both U.S. exchanges added support for the asset on the same day, according to posts from Binance founder Changpeng “CZ” Zhao and Robinhood.

The listing brings BNB, currently the world’s fourth-largest digital asset according to CoinGecko, to Robinhood’s 27 million funded accounts, marking another step in the platform’s steady expansion into crypto markets.

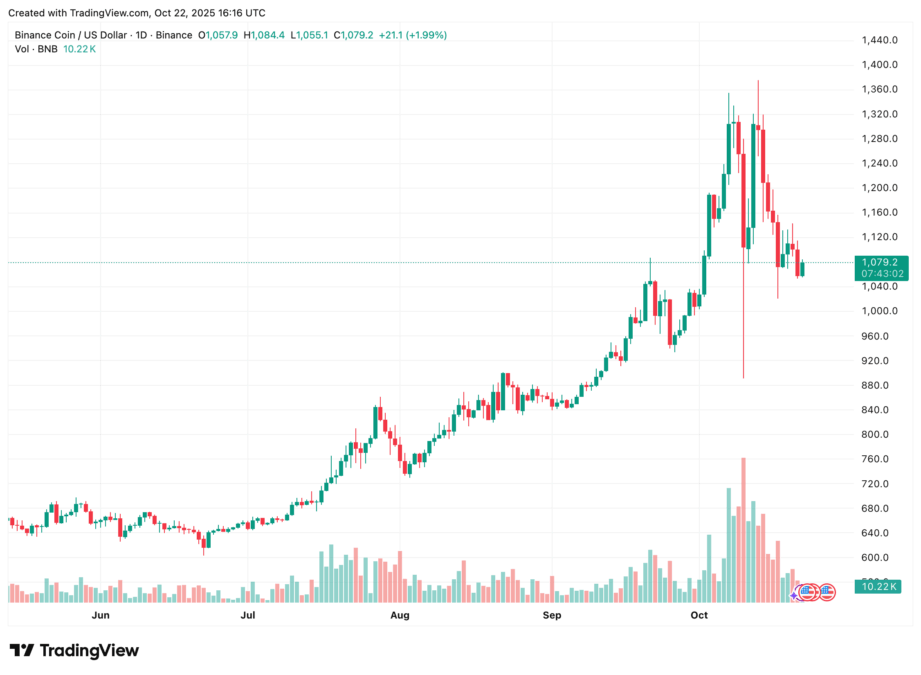

BNB’s addition follows a months-long rally that pushed its price from roughly $500 in February to a peak above $1,350 earlier this month, fueled by surging activity on PancakeSwap and the explosive popularity of BNB-based memecoins.

BNB now trades near $1,070 with a market capitalization of roughly $150 billion, according to TradingView data.

Robinhood deepens its crypto strategy

For Robinhood, the move reinforces its growing reliance on crypto trading revenue, which hit $8.6 billion in volume in August. The company continues to pivot toward tokenization and digital assets as core growth drivers, with CEO Vlad Tenev recently stating that “tokenization is like a freight train — it can’t be stopped.”

The BNB debut also follows Robinhood’s listing of Zora (ZORA) earlier this month, which sent the Ethereum-based token up more than 69% in 24 hours. That launch reflected the app effort to attract creators and retail traders to tokenized ecosystems.

The BNB and Zora listings highlight Robinhood’s effort to balance retail speculation with tokenized asset adoption, signaling its deeper shift into digital finance.

Also read: Coinbase Confirms BNB Token Listing Amid Fee Dispute Among Exchanges