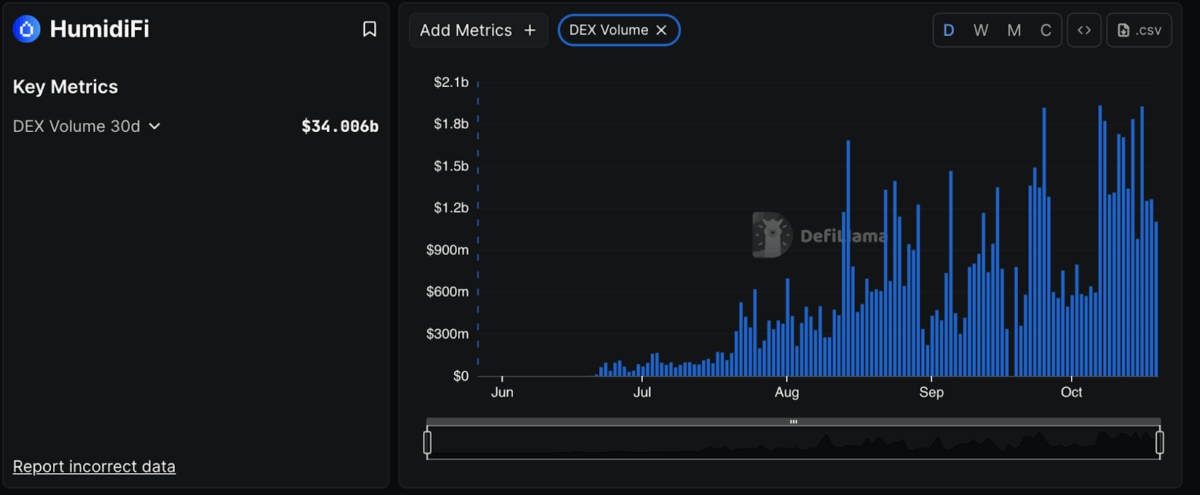

HumidiFi has become the biggest decentralized exchange (DEX) on Solana, overtaking other major platforms. Data from DeFiLlama shows it handled $1.1 billion in trades in one day, $9.7 billion in a week, and $34 billion over the past month.

Unlike many decentralized exchanges, HumidiFi operates as a dark pool, which means that trade details remain confidential. It employs a private system that conceals order information, allowing traders to sidestep price fluctuations and avoid giving others an unfair edge. As a result, large investors frequently turn to it for making substantial trades discreetly, without impacting market prices.

Private liquidity and institutional growth

HumidiFi doesn’t have a public trading page like most exchanges. Instead, trades go through aggregators, which means prices stay private and traders can keep their strategies hidden while avoiding big shifts in the market.

According to Sandwiched.me, protocols like HumidiFi can sometimes get better prices than expected, making trading more efficient. Due to its quieter trading and less volatile prices, HumidiFi has become the preferred option for many large traders, which has also caused liquidity to shift away from open exchanges like Raydium and Orca.

HumidiFi drew professional traders by offering fast and private trading. Earlier in June, it handled only a few million dollars a day, but by August, daily trades had jumped past $1 billion. Since then, its activity has stayed strong, averaging between $1.2 billion and $2 billion each day.

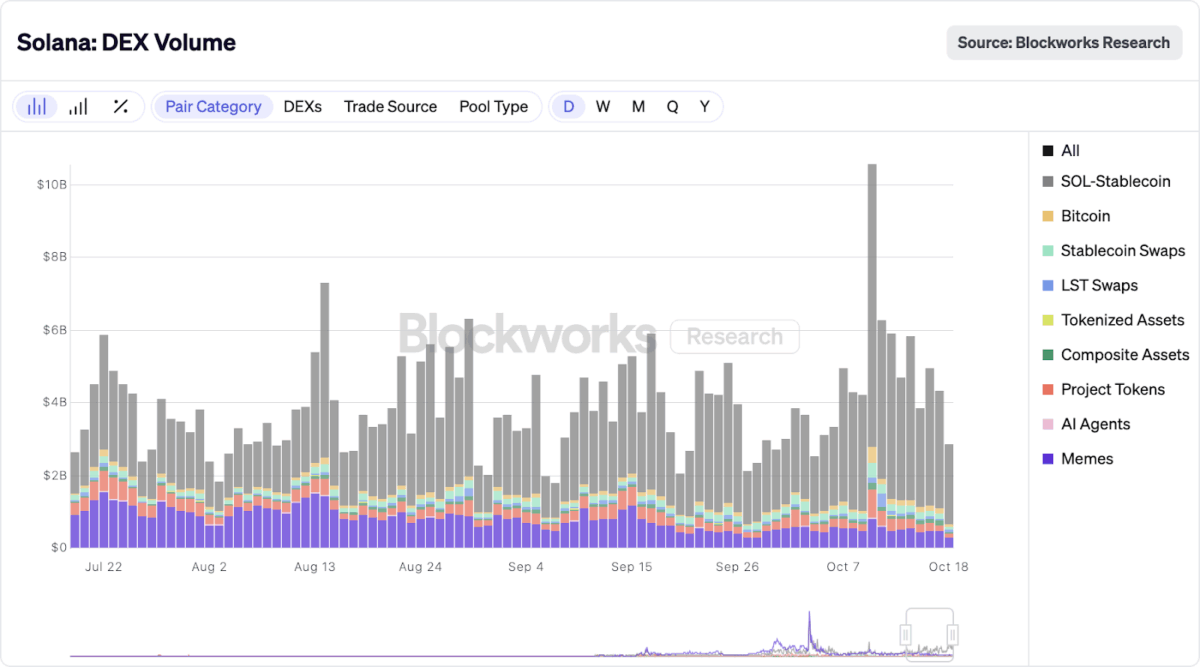

Data from Blockworks shows daily trading on Solana ranged between $3 billion and $6 billion, with highs of as much as $10 billion. Most of this trading involved swapping SOL for stablecoins USDC and USDT, with smaller portions from meme coins, Bitcoin, and liquid staking tokens.

HumidiFi’s growth shows more traders are turning to private and efficient ways to trade crypto on Solana’s network.

Also Read: Crypto Execs to Meet Senate Democrats Following Leaked DeFi Proposal