The State of North Dakota is on the verge of becoming the second U.S. state to issue its own stablecoin. The digital token, called the Roughrider Coin, is expected to launch next year through the Bank of North Dakota in partnership with Fiserv Inc.

According to a report from Bloomberg, the name “Roughrider Coin” comes from a volunteer army group led by Theodore Roosevelt, the 26th president of the United States during the Spanish-American War. Roosevelt lived in North Dakota in the 1880s, where he raised cattle and hunted. The state is proud of this history and often calls itself the “Rough Rider State.” The coin honors that connection to the past.

How the Coin Will Help Local Banks?

The Bank of North Dakota, which is the only state-owned bank in the country, will create the stablecoin. The bank usually works with more than 80 local banks and credit unions, and helps with loans for farmers and small businesses.

“We’re leveraging our 106-year history to stand up and be a leader in the banking, fintech space for North Dakota. We see this affecting the industry and continue to affect the industry, and so we’re getting involved.” Don Morgan, the bank’s CEO, said in an interview.

The Roughrider Coin will be fully backed by U.S. dollars. It will be supported by Fiserv’s new digital asset platform—using technology from Paxos Trust Co. and Circle Internet Group Inc.—for the issuance of the token. Initially, the stablecoin will be used for activities like loan advances, overnight lending, as well as construction payments between banks. Morgan said the bank may eventually offer stablecoin deposit accounts to clients.

State and Industry Support for Digital Money

Unlike Wyoming’s Frontier Stable Token, the Roughrider Coin is not meant for consumer payments in the near future. Governor Kelly Armstrong said, “As one of the first states to issue our own stablecoin backed by real money, North Dakota is taking a cutting-edge approach to creating a secure and efficient financial ecosystem for our citizens.”

Ever since the U.S President signed the stablecoin bill into law in July 2025, the creation of State-issued stablecoins had increased. Many companies have launched their own tokens, and major payment firms like Stripe, PayPal, Visa, and Mastercard have expanded into digital assets.

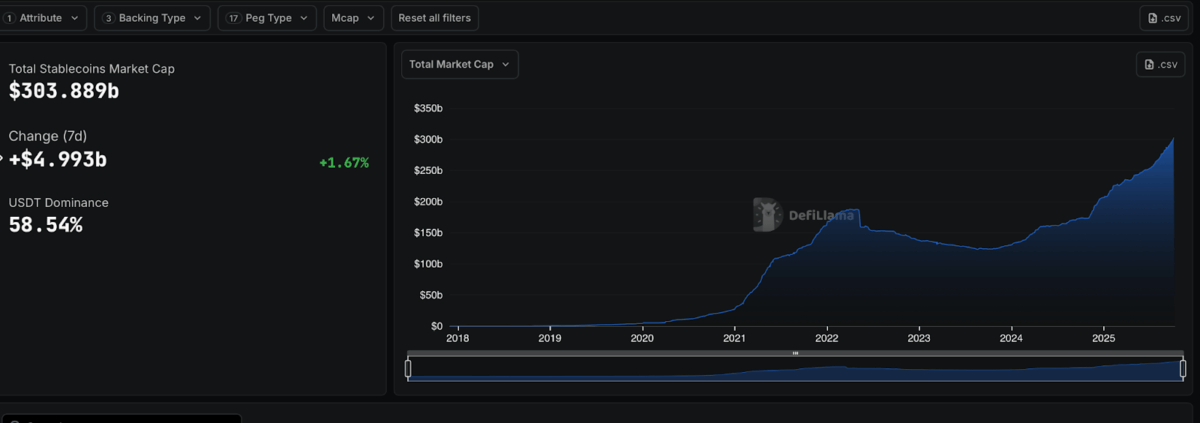

As of now, the entire stablecoin market sits at $304 billion, according to data from DefiLlama. That is a 1.67% increase in the last 7 days. Tether’s USDT is currently leading the stablecoin market with over 58% dominance, followed by Circle’s USDC and Ethena’s USDe.

Also Read: Polygon Launches Rio Upgrade To Power 5,000 TPS Payments Network