Bitcoin (BTC) has seen an increased institutional buying pressure, pushing ETF inflows to record highs. Hong Kim, Co-Founder and CTO of BitwiseInvest, emphasized that Bitcoin ETFs now inject “$5–10 billion every quarter of new buying pressure.”

Kim described this as “an unstoppable secular trend that even the four-year cycle cannot stop,” adding that 2026 will likely be another strong year. Kim shared a chart on X that showed a sharp and consistent rise in cumulative ETF inflows from early 2024 to mid-2025.

According to the chart, in just 18 months, inflows shot up from almost nothing to over $60 billion. This surge proves that more institutions now see Bitcoin as a safe and valuable asset. Besides, the biggest buys between January and July 2025 came as new spot ETFs launched and global crypto rules became clearer.

ETF assets hit record high as confidence builds

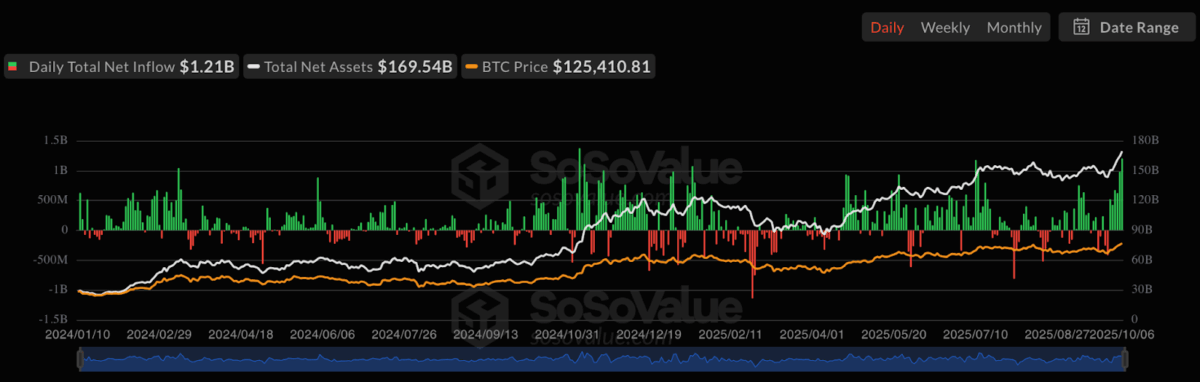

Data from SoSoValue backs up this growing trend. It shows daily inflows climbing to $1.21 billion, with total Bitcoin ETF assets hitting a record $169.54 billion. BTC ETF Trading volume has also been hitting record highs, as it has crossed the $5 Billion mark for the past few days, even crossed $8 billion in the last 24 hours.

On the chart, the white line shows assets steadily rising, while the orange line, Bitcoin’s price, stays near $125,410. The many green bars compared to red ones make it clear that big investors keep buying, with very little money flowing out.

Moreover, both Hong Kim and Elliot Andrews, speaking at Token49 in Singapore, noted that institutional investors are steadily replacing retail traders. Kim stated that Bitcoin ETFs attracted $30 billion in their first year and predicted continued momentum.

James Butterfill of CoinShares added, “This level of investment highlights the growing recognition of digital assets as an alternative in times of uncertainty.” Deutsche Bank forecasts that Bitcoin could appear on central bank balance sheets alongside gold by 2030.

Bitcoin’s steady ETF inflows confirm a shift toward institutional dominance. Hence, growing confidence and macroeconomic uncertainty are positioning Bitcoin for a long-term structural uptrend.

As of writing, data from CoinMarketCap shows Bitcoin trading near $121,709, with $81.6 billion in daily trading volume. Meanwhile, the overall crypto market is at $4.16 trillion in value, though it has eased by about 2% over the past 24 hours.

Also Read: GraniteShares Targets 3X Crypto ETFs as Demand Surges