Bitcoin, the largest cryptocurrency in the world by market cap, reached a new high of $126,198 today and it seems to have dragged Ethereum price along as it crossed above $4,700 after nearly a month.

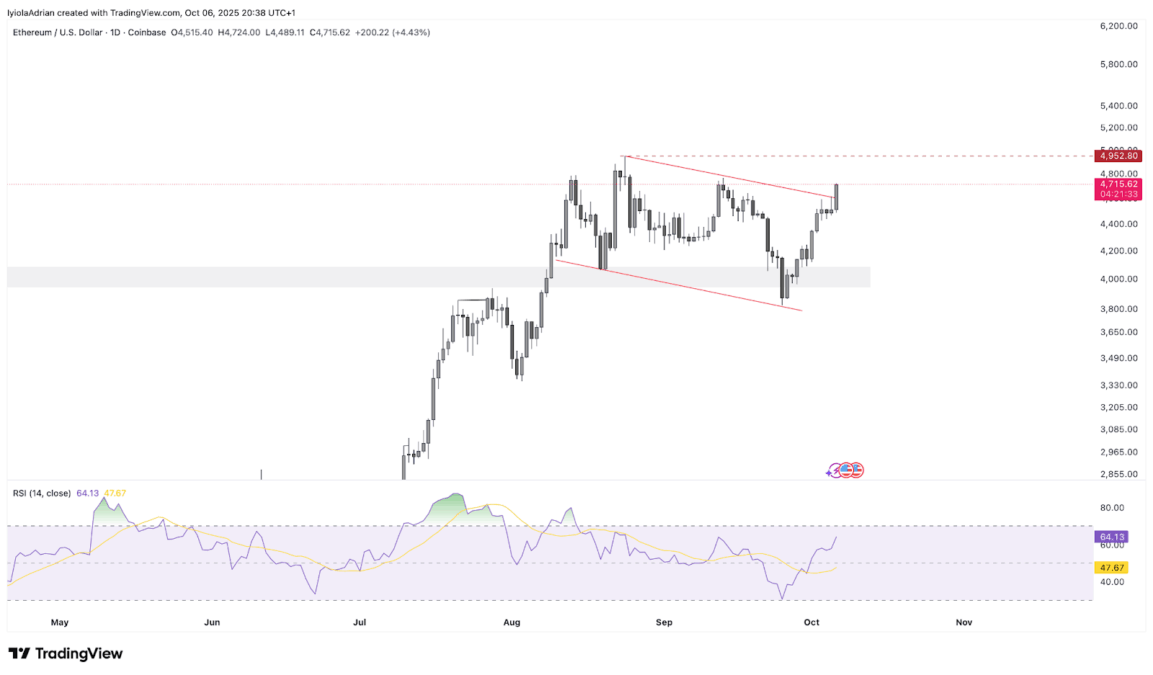

At the time of writing, Ethereum is trading for $4,711, a level it has been consolidating in for the past 2 months and forming a bullish flag pattern in its path. However, following Bitcoin’s momentum, the price broke out today, giving a 4.66% surge from the previous day.

As per CoinMarketCap data, ETH is currently only 5% short from its all-time high of $4,953 which it reached on August 25. Analysts expect this breakout to give the token the momentum it needs to create a new high. Moreover, the Relative Strength Index (RSI) is currently at 63, which means the bulls are in control and there’s still room for more push.

Whale Activity Influence Surge in Price

Meanwhile, whale activity seems to have influenced the recent surge. In a recent tweet on X, Crypto analyst Ali reported that Whales bought 800,000 ETH in the past week. This is more than $3.6 billion and accounts for 25% of the crypto’s circulating supply.

In addition to that, interest in Ethereum ETFs is still growing with over $1 billion following into these funds since the beginning of the month. At the same time, the number of Ethereum coins held on exchanges has dropped to a nine-year low of about 16.1 million. This means that investors are moving their holdings to private wallets which reduces the chances of selling.

Grayscale Launches Staking-Enabled Crypto ETFs in U.S

The surge comes as Grascale launches spot crypto exchange-traded funds in the U.S. It includes the Ethereum Trust ETF (ETHE), Ethereum Mini Trust ETF (ETH), and Solana Trust (GSOL), as reported by the CryptoTimes earlier.

“Staking in our spot Ethereum and Solana funds is exactly the first mover innovation Grayscale was built to deliver. As the world’s #1 digital asset-focused ETF issuer by AUM, we believe our trusted and scaled platform uniquely positions us to turn new opportunities like staking into tangible value potential for investors.” Peter Mintzberg, CEO of Grayscale, said.

The products together manage over $8.25 billion in assets under management for U.S. clients. The ETFs also include a staking feature, which allows investors to earn rewards while still holding the cryptocurrency. Grayscale said it will stake the assets through a network of custodians to ensure transparency.

The company explained that staking lets investors passively earn rewards from proof-of-stake blockchains while keeping their holdings accessible through regular brokerage accounts.

Also Read: Bitcoin Eyes New High This Week as Market Optimism Fuels Rally