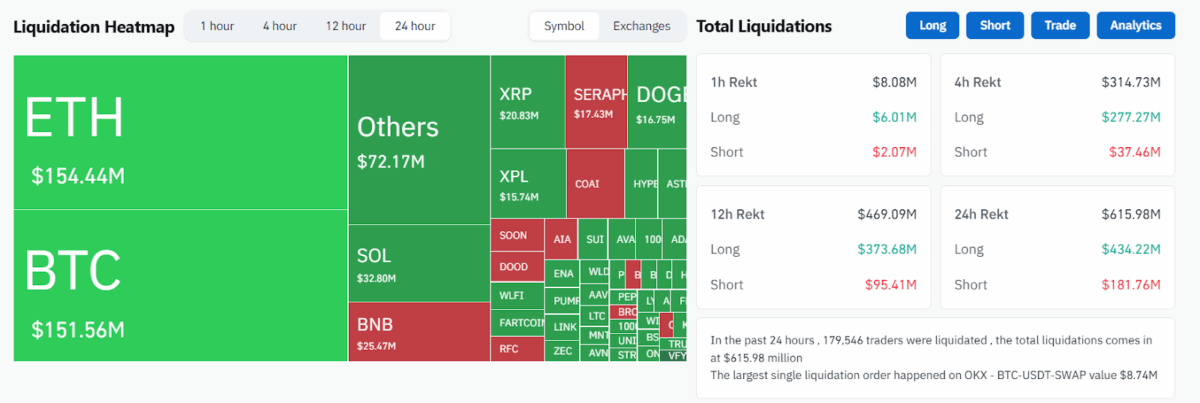

A wave of liquidations swept across the crypto market on Tuesday, wiping out more than $600 million in leveraged positions within 24 hours as Bitcoin retreats from its all-time high.

According to data from Coinglass, the sharp downturn was concentrated in Bitcoin and Ethereum, which together accounted for nearly 60% of total liquidations. The heatmap shows significant long-position wipeouts across Binance, OKX, and Bybit, suggesting overextended leverage after last week’s euphoria.

Bitcoin (BTC) had briefly surged past $125,000 last week, setting a new all-time high before sliding back to $121,000 amid profit-taking and renewed macro uncertainty. Ethereum (ETH), meanwhile, has remained relatively resilient, trading near $4,480 after institutional accumulation offset broader market weakness.

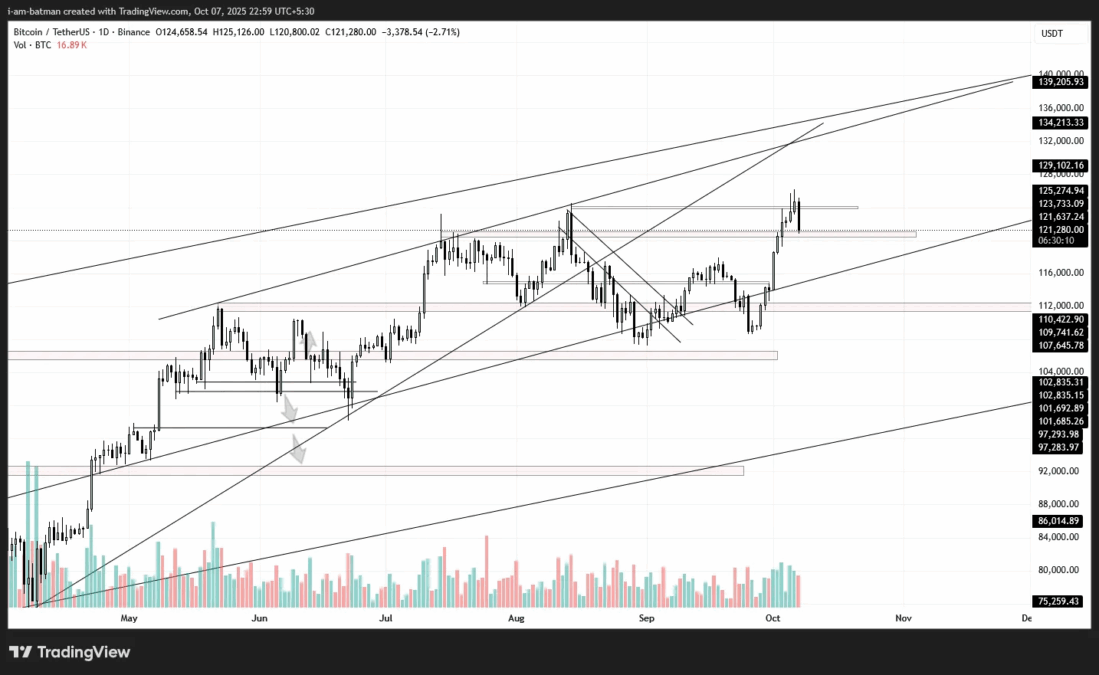

BTC Tests Channel Support After $125K Rejection

Bitcoin’s retreat from its all-time high appears technically driven, as price action shows a clear rejection near $125,000, aligning with the upper boundary of a multi-month ascending channel. The daily chart highlights the asset consolidating around $121,000, testing short-term support after a steep 7% pullback from recent highs.

The move reflects a textbook mid-channel correction following an overheated rally. Immediate support lies between $120,500–$116,000, a key confluence zone formed by previous breakout levels and the channel’s midline trend. A sustained close below this zone could extend losses toward $112,000–$110,000, where deeper buying interest has historically emerged.

Meanwhile, resistance remains intact at $123,700–$125,000, and only a decisive breakout above that range would revalidate bullish momentum toward $129,000 and $134,200.

Trading volume has eased compared to last week’s surge, signaling profit-taking and leverage cooling, rather than panic selling. The broader structure still favors bulls as long as Bitcoin holds above $110K, keeping the macro uptrend intact.

Crypto market cools as traders de-risk

Tuesday’s trading session reflected the broader cooldown. Bitcoin dominance slightly declined to 53.4%, while Ethereum’s market share stabilized around 18.7%. Altcoins such as Solana, XRP, and AVAX fell between 3–5%, tracking lower volumes on major exchanges. Funding rates across perpetual markets normalized after spiking last week, suggesting that traders are de-risking after the weekend’s volatility.

The first week of October opened with renewed investor activity across the digital asset market. Bitcoin’s record-breaking surge above $125,000, paired with the steady rise in stablecoin supply and institutional accumulation of BTC and ETH, underscored a continued appetite for crypto exposure—though sentiment has now cooled from euphoric to cautious optimism.

The Stablecoin market continued its steady expansion, rising $5.48 billion during the week. On Ethereum, USDT and USDC supplies grew by $2.24 billion, while on Plasma they declined by $716 million, reflecting liquidity migration back to established Ethereum-based protocols where institutional DeFi products and yield strategies remain dominant.

Institutions hold firm as crypto rotation tempers Uptober rally

Market data suggests capital is consolidating within established ecosystems, Ethereum for stablecoin issuance and major DEXs, Bitcoin for institutional reserves. While trading volumes have cooled, accumulation from corporate holders like Bitmine and Metaplanet continues, hinting at persistent institutional conviction even amid price volatility.

Investors also appear to be booking profits after Bitcoin’s record peak, leading to short-term sell pressure but not a structural reversal. The continued inflows into stablecoins and the absence of widespread panic suggest the market may be rotating rather than retreating.

As “Uptober” unfolds, the tone has shifted from unbridled optimism to tempered confidence. The current correction may serve as a reset, flushing out excessive leverage and setting the stage for a more sustainable uptrend, if capital rotation and institutional demand persist through the month.

Also read: Vietnam Prepares for Crypto Market Pilot, No Proposals Received Yet