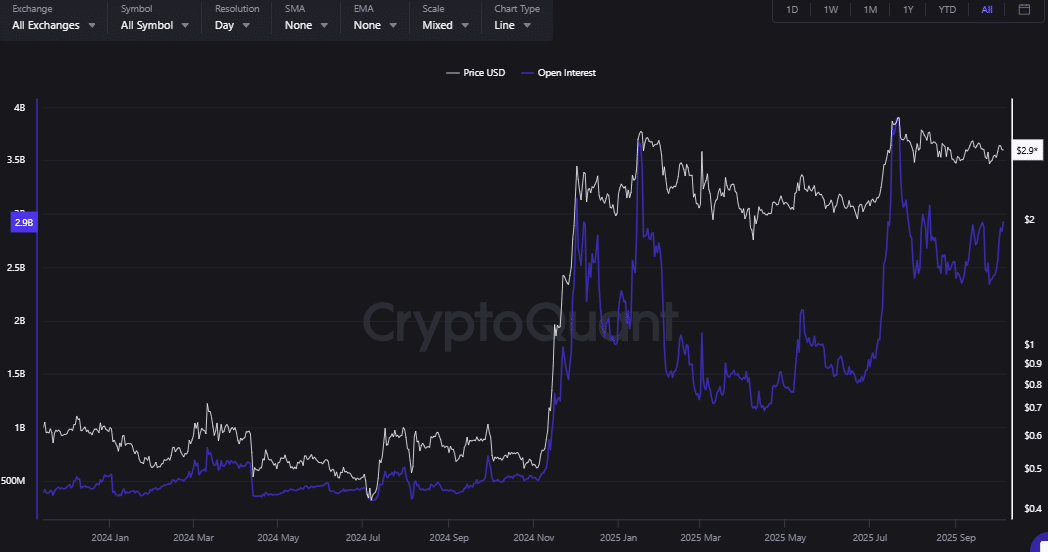

XRP has drawn heated trader interest, with open interest in perpetual contracts and futures spiking to almost $2.92 billion on October 5, 2025.

According to CryptoQuant, this surge in leveraged positions arrives as XRP trades slightly below the $3 level, a crucial resistance point that has consistently challenged trader psychology this year.

Price action with open interest

Open interest calculates the overall value of outstanding leveraged contracts and reflects how much is being bet on future price action. Historically, XRP’s open interest has followed its price action.

In 2024, open interest was at less than $1 billion as XRP traded below $1. In early 2025, speculation pushed XRP’s open interest above $3 billion. The price briefly rose above $3.50, but mid-year liquidations caused it to drop again.

The recent rally sees traders adding positions at the $3 level again. As billions of dollars were bet against it, XRP has not yet convincingly broken above the level, establishing a high-stakes equilibrium between bull and bear forces.

According to CoinMarketCap, XRP is currently trading at $2.99, falling 0.59% on the day, with a market cap of $179.16 billion, marking a slight 0.58% drop. The token is far below its all-time high of $3.84, recorded back on January 4, 2018.

If XRP breaks above $3, the high open interest could trigger a short squeeze and push prices higher. But if it falls back to $2.90, it may set off liquidations that may lead to more losses.

Contributing to market momentum, a recent blockchain transaction highlighted by Whale Alert indicates 18.7 million XRP, valued at approximately $55.8 million, transferred from an unidentified wallet to Ripple.

Also Read: XRPL Gears Up for Institutional Adoption with Privacy and DeFi