BNB climbed above $1,200, setting a new all-time high as traders saw massive liquidations across the market. According to CoinMarketCap, BNB was trading at $1,202.01 with a daily trading volume of $4.21 billion, up nearly 2% in the past day. Even with this rally, the overall crypto market value dropped by 1.12% to $4.22 trillion.

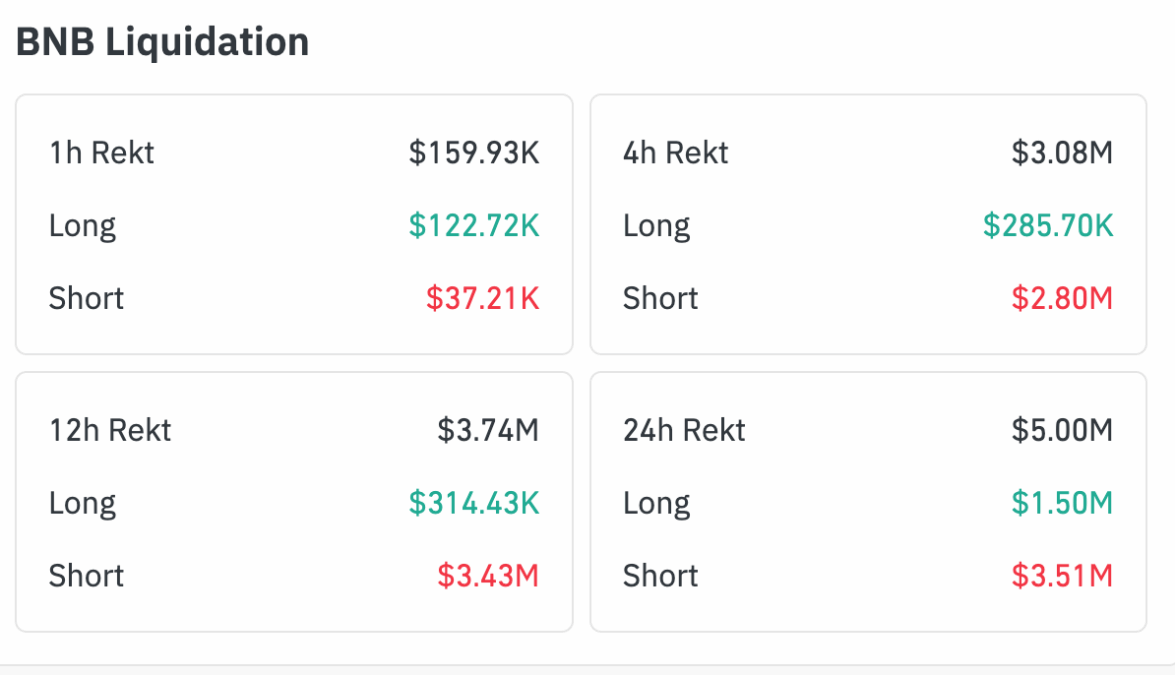

According to Coinglass data, around $5 million worth of BNB positions were liquidated in the past 24 hours. Most of these losses came from short traders, who lost $3.51 million compared to $1.50 million from long positions.

This trend confirms that prices moved upward, catching bearish traders off guard. Within 12 hours, liquidations totaled $3.74 million, led by $3.43 million in short positions. During the last four hours, the market saw another $3.08 million wiped out, mostly from shorts.

Funding rates signal bullish bias

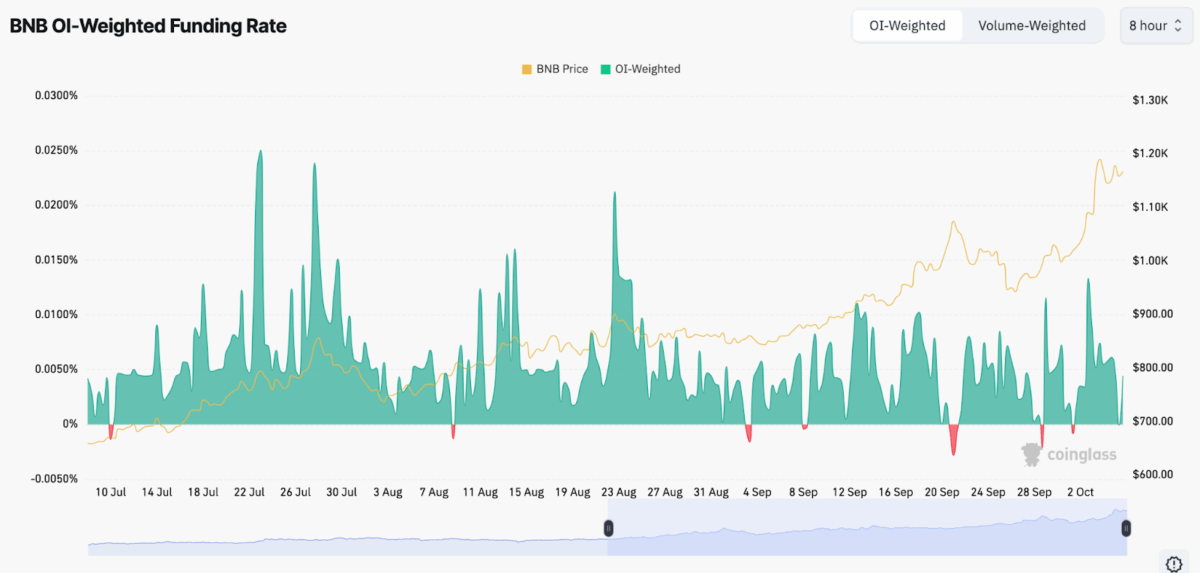

Besides that, data shows BNB’s funding rate has stayed mostly positive since mid-July. This means traders betting on price increases have been paying small fees to those betting against it, something that usually happens in strong uptrends. Also, big jumps in these rates during late July, mid-August, and late September matched BNB’s price rallies.

At the start of August and again in mid-September, the funding rates briefly dropped below zero, showing that sellers were in control for a short while. But that didn’t last long. Buyers stepped back in, and optimism returned, an indication of confidence in BNB’s growth.

Market sentiment and technical outlook

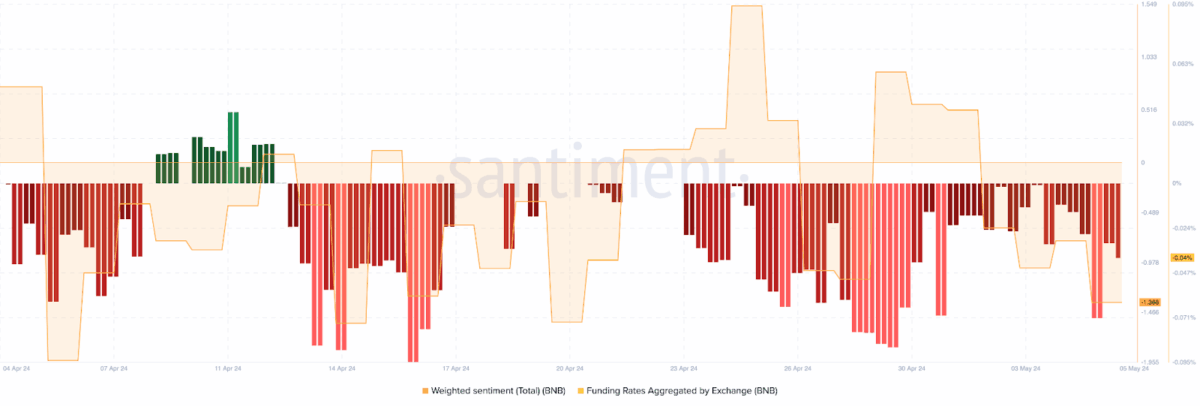

According to data from Santiment, it seems that investor sentiment around BNB took a downturn from late March to early May 2024. The funding rates were in the red, which suggests that the market was feeling a bit cautious, and the weighted sentiment mostly stayed below zero. However, recent price movements are telling a different story.

Crypto Claws noted, “$BNB just hit a new all-time high, signaling potential exhaustion after a strong parabolic rally.” The analyst added that smart money might take profits soon, potentially leading to a correction toward $700 by December.

BNB’s jump above $1,200 shows strong buying power, but the growing liquidations and high funding rates suggest the market might cool off soon.

Also Read: DeFiLlama to Drop Aster Perps After Binance Volume Similarities

Disclaimer: The Crypto Times does not endorse or recommend any specific cryptocurrencies, tokens, projects, financial products, or investment strategies. We do not accept legal liability for any financial losses incurred as a result of reliance on information published by us. Readers should always do their own research (“DYOR”), consult with licensed professionals, and evaluate risks independently.