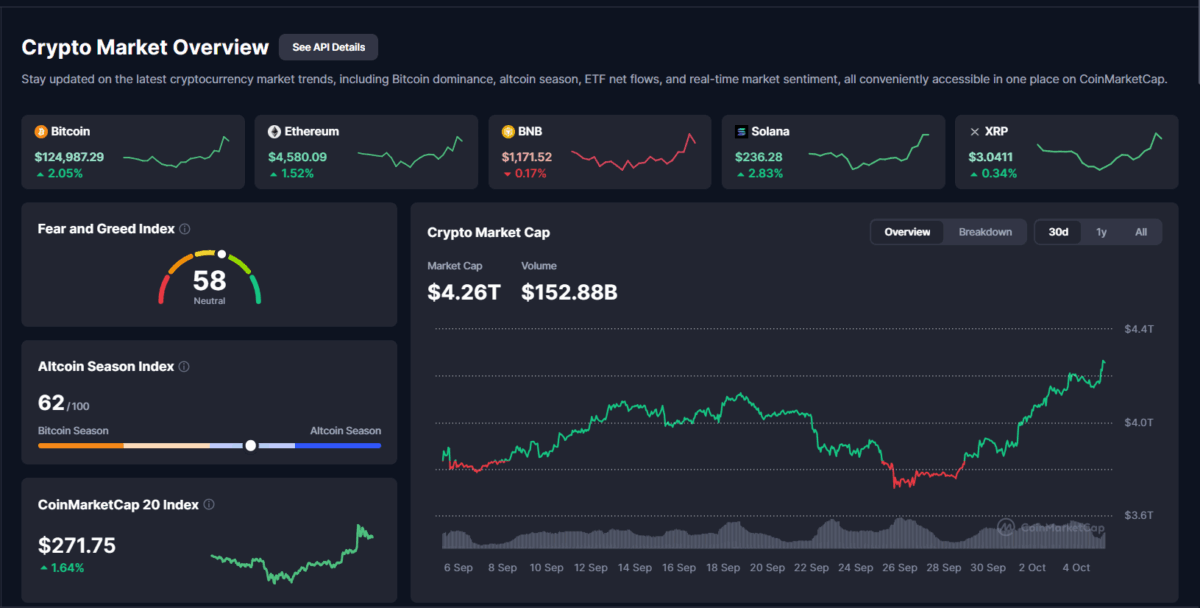

Bitcoin (BTC) has officially surged past the $125,000 mark, setting a new all-time high as of Monday, according to data from CoinMarketCap. The flagship cryptocurrency is now trading at $124,980, up 2.03% in the past 24 hours, with major exchanges like Binance, Bybit, and Coinbase showing BTC hovering between $125,034 and $125,077.

This milestone comes amid renewed optimism across global crypto markets, driven by increasing institutional adoption and macroeconomic factors favoring risk assets. The price rally has sparked strong activity across spot and derivatives exchanges, with liquidity pools deepening and open interest climbing to multi-month highs.

Exchange Data Snapshot

| Exchange | Pair | Price (USD) |

|---|---|---|

| Binance | BTC/USDT | $125,034.86 |

| Binance | BTC/FDUSD | $125,055.42 |

| Bybit | BTC/USDT | $125,044.05 |

| Coinbase | BTC/USDT | $125,077.00 |

| OKX | BTC/USDT | $125,052.55 |

| Upbit | BTC/KRW | ~$126,513.78 |

Market Context

The new high reflects Bitcoin’s growing status as a macro hedge and digital reserve asset, with analysts pointing to robust ETF inflows, corporate treasury accumulation, and global liquidity easing.

Market sentiment indicators such as the Crypto Fear and Greed Index is moving towards greed as ” signaling heightened retail participation and bullish momentum.

The rally also comes amid fresh institutional demand following the approval of multiple crypto ETFs in recent months, and as central banks in major economies pivot toward interest rate cuts, further boosting risk appetite.

Analysts’ Take

Traders are eyeing $135,000 as the next psychological resistance, as on-chain data from Glassnode shows a shift in accumulation trend among mid-sized BTC holders.

Standard Chartered’s Global Head of Digital Assets Research, Geoff Kendrick, predicts that Bitcoin may continue climbing past $135,000 this quarter. Meanwhile, Bitcoin’s market dominance has climbed above 55%, reaffirming its position as the primary driver of the broader digital asset market.

Also Read: Bitcoin Nears Record High as Crypto Market Hits $4.2 Trillion