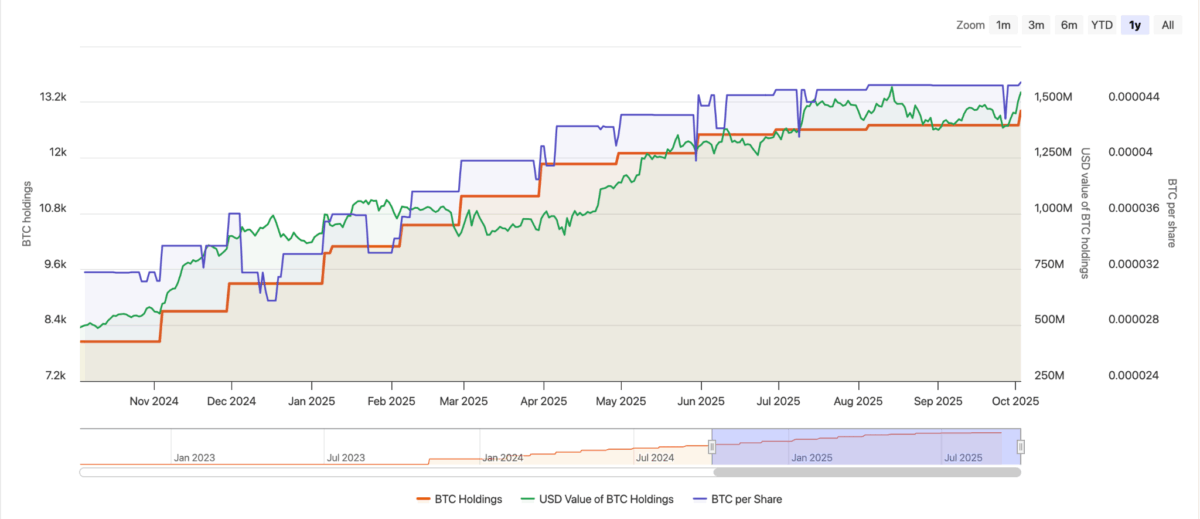

CleanSpark (Nasdaq: CLSK) has expanded its Bitcoin treasury to 13,011 BTC following its September production update, the company disclosed Friday. The U.S.-based miner produced 629 BTC last month, up 27% year-on-year, while boosting fleet efficiency by 26% over the same period.

September capped a transformative fiscal year in which CleanSpark reached 50 exahashes per second (EH/s) of operational hashrate, completed the acquisition of GRIID Infrastructure, and expanded its Bitcoin-backed credit line by $200 million. The miner also launched a derivatives program to optimize treasury yields and hedge volatility.

The company reported an average daily output of nearly 21 BTC, with peak daily production reaching 21.7 BTC. Total production for 2025 so far stands at 5,925 BTC. CleanSpark also sold 445 BTC in September for $48.7 million at an average price of $109,568, highlighting active treasury management to fund operations.

The firm operates 241,934 machines across U.S. data centers with peak efficiency of 16.07 J/Th, backed by 1.03 GW of contracted power and 808 MW in use. CEO Matt Schultz said it is entering “a new chapter” as it seeks to leverage Bitcoin and energy infrastructure for long-term growth.

Treasury strategy at the center of mining evolution

The latest update follows CleanSpark’s August earnings report, where Q3 revenue hit a record $198.6 million, nearly doubling year-on-year and beating analyst forecasts. Net income reached $257.4 million for the quarter, underscoring the miner’s profitability despite increasing hashrate competition.

CFO Gary Vecchiarelli emphasized at the time that operational expenses were fully funded through Bitcoin production while still allowing CleanSpark to expand its treasury, which had already surpassed 12,700 BTC by the end of Q3. That milestone has now been extended beyond 13,000 BTC, ranking 9th in largest Bitcoin holder, according to BitcoinTreasuries

CleanSpark’s production gains and fiscal milestones underscore the sector’s shift toward balance sheet management, where Bitcoin treasuries are leveraged as financial instruments rather than speculative reserves.

By combining Bitcoin-backed credit, derivatives, and active treasury strategies, the firm positions itself as both miner and capital manager, straddling energy and digital assets. With rivals like Riot and IREN pursuing similar paths, treasury management may prove decisive in determining which operators scale sustainably in the post-halving landscape.

Also Read: CleanSpark Reaches 10,000 Bitcoins Mined in U.S.-Based Operations