Canaan Inc. stock jumped more than 26% in early trading Thursday after the crypto mining hardware maker secured its largest sale in over three years. The Nasdaq-listed company announced that a U.S.-based buyer ordered 50,000 units of its latest-generation Avalon A15 Pro rigs, though the client’s name was not disclosed.

In an official release, CEO Nangeng Zhang said the deal reflects both companies’ “confidence in the long-term growth of bitcoin mining and the market’s demand for highly efficient, next-generation infrastructure.”

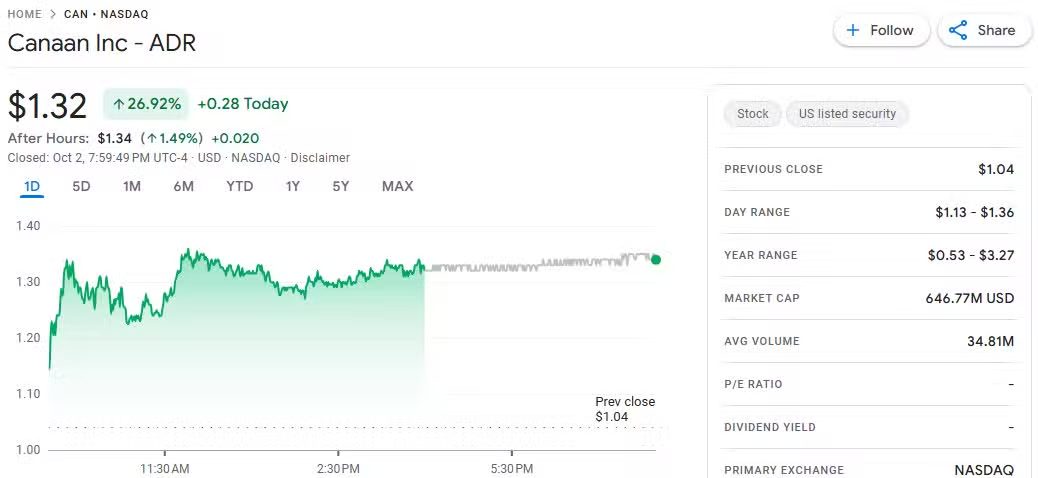

At the time of writing, Canaan shares traded at $1.32, up 26.92% for the day, according to Google Finance. The stock has gained more than 83% over the past one month, despite being down 35% year-to-date.

Bitcoin mining faces rising challenges

The sale comes as the Bitcoin mining industry grows increasingly competitive. The United States, home to 36% of the global Bitcoin hashrate, remains the world’s largest mining hub, according to Hashrate Index.

Bitcoin mining involves the use of computing power to authenticate transactions and insert new blocks into the blockchain. Bitcoin is being minted and given to miners as a reward, although the task is becoming more challenging.

Mining difficulty, which adjusts every two weeks, recently hit 150.84 trillion, the highest ever recorded, according to Coinwarz. This rising difficulty has made mining more expensive and forced smaller players to exit the market.

The growing challenge has already forced some players out. In June, Bit Digital shut down its Bitcoin mining business to focus on Ethereum, warning the industry may not survive future halvings.

In the meantime, giant publicly-traded miners such as Marathon Digital (MARA), Iris Energy (IREN), Cango, and CleanSpark are gaining market share, and together they control close to 20% of the block rewards in July, according to a TheMinerMag report. But even lone miners occasionally get a fortune, two individual miners this year having each won prizes worth more than $350,000.

Canaan’s mega sale highlights ongoing demand for advanced mining equipment, even as the industry faces rising costs and tougher competition. While institutional miners continue to dominate, small players make a profit and keep Bitcoin mining difficult and dynamic.