Citigroup, one of the biggest banks in the world has raised its forecast for Bitcoin, saying the world’s largest cryptocurrency could surge to $231,000 within the next 12 months.

The firm said this as its bull case, but sets its base case at $181,000 and its bear case at $82,000. The bank also expects Bitcoin to end this year at around $132,000, which would set a new all-time high.

In addition, the bank also released an update for its prediction on Ethereum. It predicts that the second-biggest digital token could reach $7,300 in its bull case with a base case set at $5,400, and a bear case of $2,000.

For the end of this year, Citi expects Ethereum to reach $4,500. This is a shift from its earlier projection that suggested it could drop to $4,300.

“Bitcoin remains our preferred asset as it captures an outsized portion of incremental flows into crypto markets,” Citi analysts said in the research. The firm highlighted that Bitcoin continues to trade above adoption-based estimates and that the “digital gold” narrative is still driving interest. Ethereum, in contrast, carries more uncertainty due to shifting user activity on its network, though staking and decentralized finance continue to attract institutional attention.

Big Money Flows Into Bitcoin

Meanwhile, this new outlook is coming at a time Bitcoin exchange-traded funds are seeing more inflow. According to data from SoSoValue, BTC ETFs recorded more than $1.6 billion in inflows across three days at the start of October.

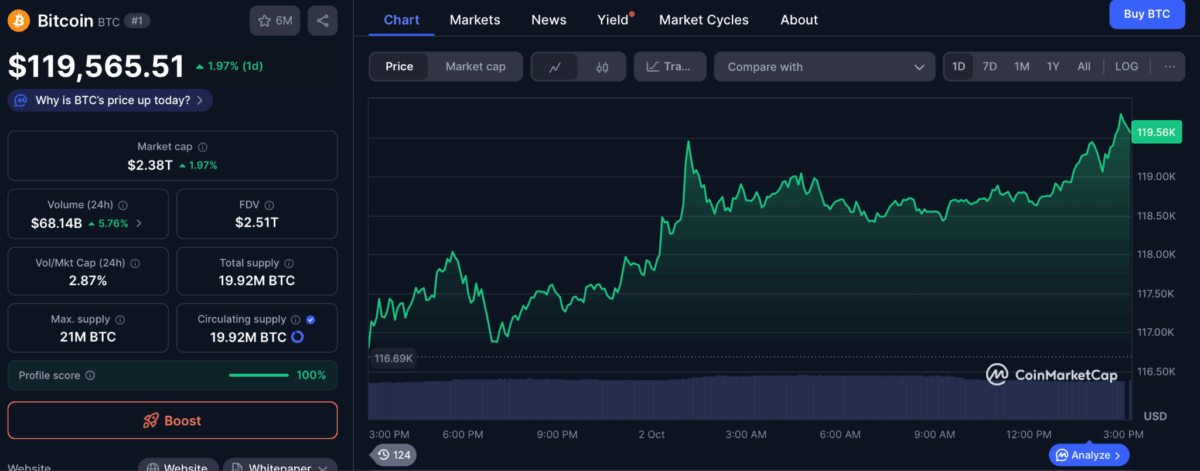

On October 1 alone, inflows hit $675.81 million, which was the largest daily total since early September. Bitcoin’s price has responded to that, and surged above $119,000 with a 2% gain since the start of the month.

Citigroup also pointed to economic conditions that are supporting crypto prices. The recent ADP jobs report showed the labor market is getting weaker, which increased the chances that the U.S. Federal Reserve may cut interest rates at its October meeting.

Historically, such conditions have favored Bitcoin, and October itself has been one of its strongest months, with average gains above 20 percent.

Also Read: Bitwise Launches Covered Call ETFs for Circle Stock and Ether