Bitcoin is holding strong around $118,700, with signs of pushing higher toward $130,000. As of writing, CoinMarketCap data shows Bitcoin trading at $118,716 with more than $69 billion in trading volume in the past day. Besides, the entire crypto market has grown to $4.08 trillion, climbing 2.15% in just 24 hours.

CryptoQuant analyst AxelAdlerJr noted that Bitcoin remains in the STH-MVRV pricing corridor, which tracks short-term holders’ profitability. “The upper boundary of this range (+1σ) currently runs around $130K and serves as a zone where short-term holders more actively lock in profits,” he explained.

Since early 2024, Bitcoin has stayed above its average buying price, showing strong confidence. Because of this, the climb toward $130K is still likely if current trends continue.

Analysts See Next Targets Above $130K

Another analyst agrees. Ali_charts on X said that after Bitcoin passed $117,000, the next target could be $139,000.

Additionally, CryptoQuant’s Crypto Dan explained that long-term holders remain steady. “The current market is progressing slowly within the bull cycle, but there are no signs of an imminent end. In fact, a strong upward move may be just around the corner,” he noted. Hence, the broader cycle still suggests growth potential before any peak conditions emerge.

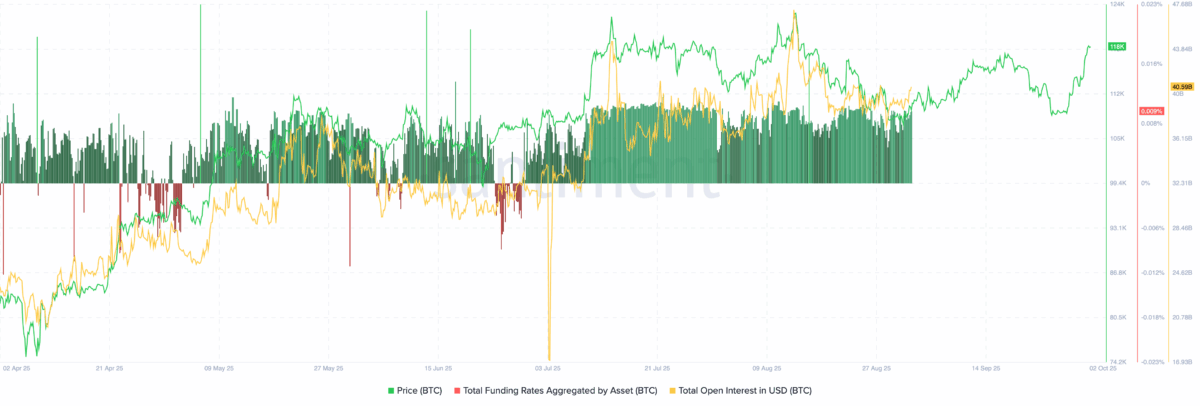

On-chain and derivatives data also show strength. According to Santiment data, funding rates are holding steady at 0.009%. This indicates that neither the long nor short positions are taking over, which minimize the risks of a rally driven by leverage.

Open interest has climbed to $40.59 billion, showing more traders are getting involved without risky borrowing. This means the rally looks driven by real demand and steady positions.

The chart shows that Bitcoin recovered quickly from September losses below $90,000, indicating backing from large investors.

Bitcoin’s climb looks well-grounded. With healthy trading, growing interest, and steady support, a run toward $130K feels increasingly possible.

Also Read: Bitcoin Miners Hit $56B Market Cap Despite Falling Margins