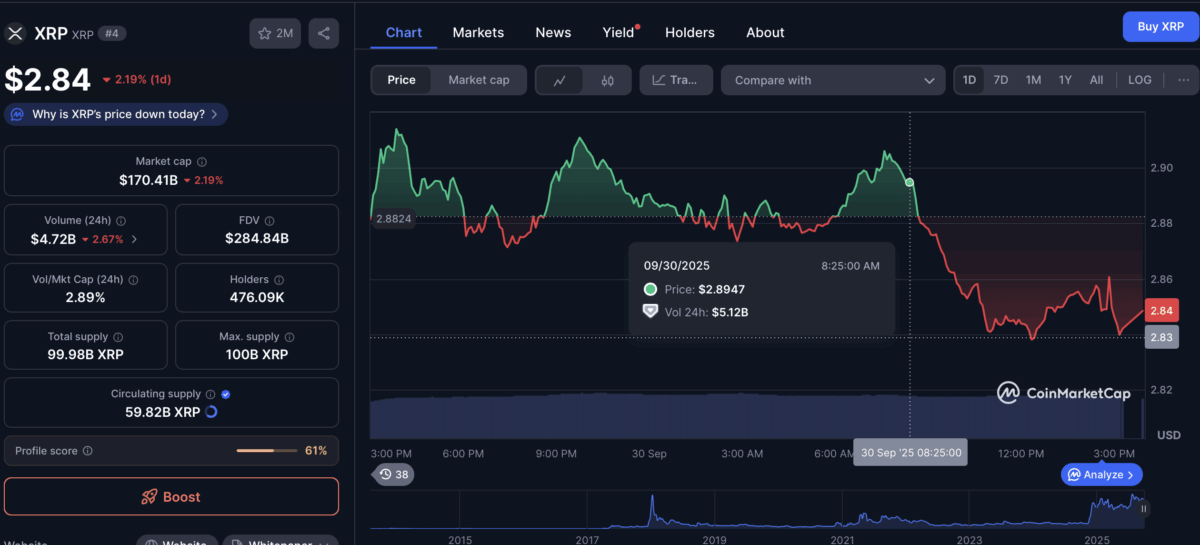

XRP, the native token of Ripple, is currently trading for $2.84, which is near its monthly open of $2.77 after losing 15.79% of its gains over the last two weeks.

The question now is what October, or “Uptober” as it’s called in the crypto space, will bring. Historically, it’s a month that gives mixed signals in the Market.

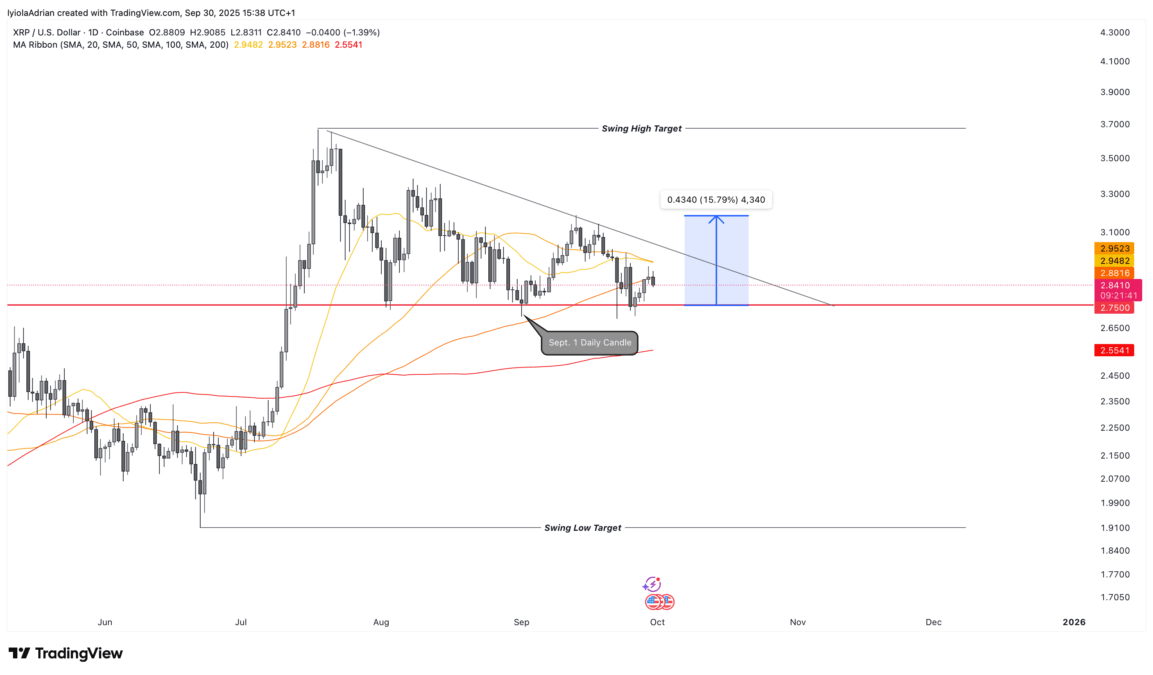

Price Needs to Hold Above $2.75 Level

Looking at the chart, there’s a key level at $2.75, which matches the opening price on Sept. 1 and marks the lower boundary of a symmetrical triangle pattern on the daily chart.

If XRP stays above this level, it could break past the $2.86 mark, which also matches the 100-day simple moving average, and open the way for the price to hit $3.62, the swing high target of the triangle.

On the other hand, a dip below $2.75 could push XRP down toward $2.00, which is the bearish target of the same pattern.

Meanwhile, data from Glassnode indicate that almost 1.58 billion XRP were bought between $2.72 and $2.75, which means there’s strong demand in this price range. However, there is also a big supply of XRP around $2.81, which could hinder any recovery efforts.

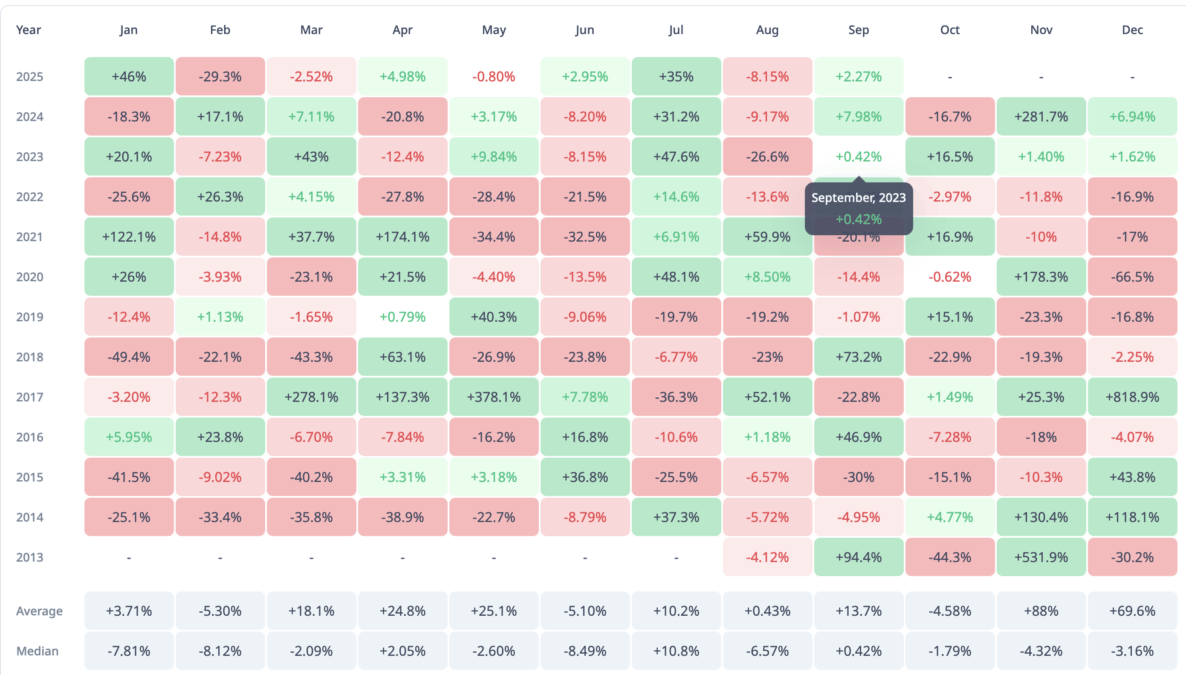

Why “Uptober” Feels Like a Rollercoaster

“Uptober,” however, has not been a friendly month for XRP. Since 2013, the token has closed in the red in seven out of 12 Octobers, with average returns of about -4.58%, according to Cryptorank.

But the story changes in the last quarter of the year. Between October and December, XRP has been at its strongest, averaging gains of about 51%. In 2024, XRP jumped nearly 240% in Q4, while in 2023 it rose by 20%, and back in 2017, it recorded a stunning 1,064% rally in just two months. Even during bear cycles, like 2018’s –39% or 2022’s –29%, Q4 was still a period of large moves.

In addition to that, the month also focuses on new XRP ETF filings. Franklin Templeton’s application has a deadline on November 14, Grayscale’s decision comes on October 18, and other filings face deadlines between October 19 and 25. The SEC will decide on at least six XRP ETFs in October.

Analysts say approvals could bring $4–$8 billion into XRP in the first year, though some warn this news may already be priced in, which could cause a quick “sell the news” reaction.