Tether, the issuer of the world’s largest stablecoin (USDT), has significantly increased its Bitcoin (BTC) holdings, purchasing 8,888 Bitcoin, valued at approximately $1 billion.

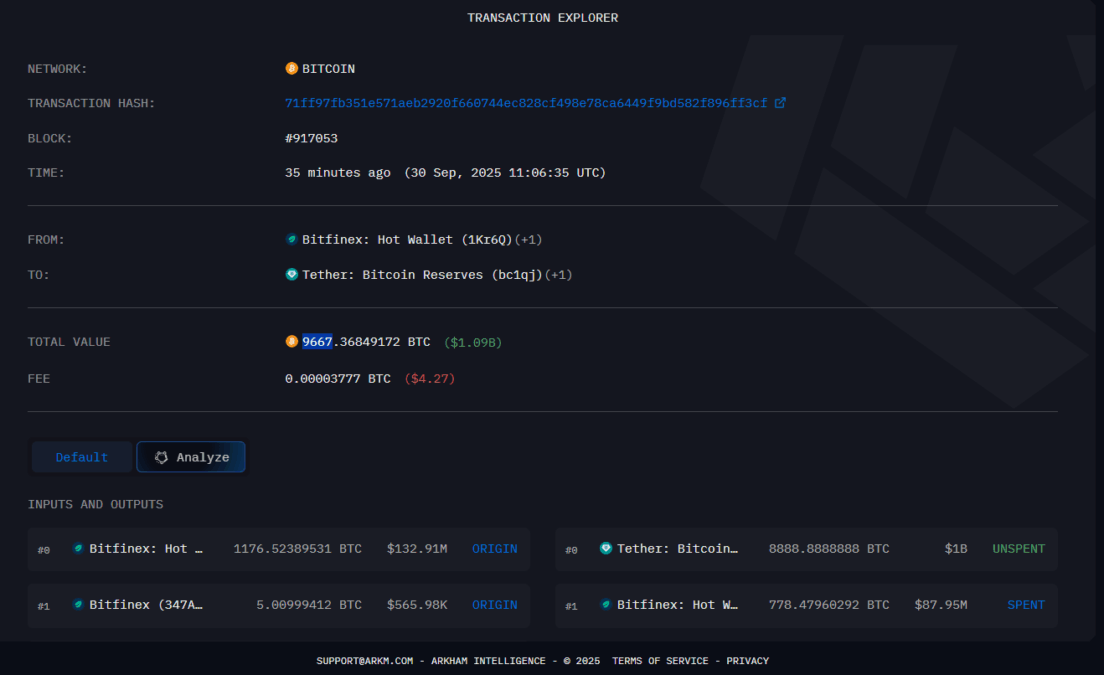

The massive buy was settled on the Bitcoin blockchain today, with an on-chain transaction showing the newly acquired coins moving from a Bitfinex exchange wallet directly to Tether’s publicly declared reserve address.

The acquisition, identified via the transaction hash on Arkham’s blockchain explorer, reflects Tether’s strategic move to bolster its BTC holdings. This purchase aligns with growing institutional interest in cryptocurrency as a store of value.

Purchase in the context of total reserves

This latest acquisition builds upon Tether’s existing holdings. According to its most recent attestation report, the company’s reserve composition was as follows:

- Cash & Cash Equivalents: 79.94%

- Secured Loans: 6.24%

- Bitcoin: 5.49%

- Precious Metals: 5.37%

- Other Investments: 2.96%

With this new $1 billion purchase, the stablecoin issuer’s allocation to Bitcoin is set to increase notably in its next quarterly report.

The move signals Tether’s dual strategy: leveraging Bitcoin for growth and as a hedge against inflation, while simultaneously maintaining the vast majority of its reserves in highly liquid and stable assets like U.S. Treasury Bills to ensure the stability of the USDT peg.

Tether has not publicly commented on the transaction. The Bitcoin market has remained stable following the purchase, with no immediate price impact observed.

Also Read: Tether Plans Capital Raise at $500B Valuation, CEO Says