Bitcoin is struggling to clear the $115,000 mark as market swings shape investor sentiment ahead of ‘Uptober’, a synchronic word used for October month where crypto prices historically have usually gone up.

Just last week, the price dropped to $108,000, marking a 13% dip from its all-time high of $124,457, as per CoinMarketCap data. This sudden drop has raised eyebrows, making people wonder if the rally has already hit its peak. Bitcoin has since rebounded, with it now trading at $113,940 as of writing, with its volume at $61 billion.

The global crypto market cap climbed 1.9% to $3.91 trillion, while total market volume surged 41.88% to $177.4 billion.

Technical setup suggests mixed signals

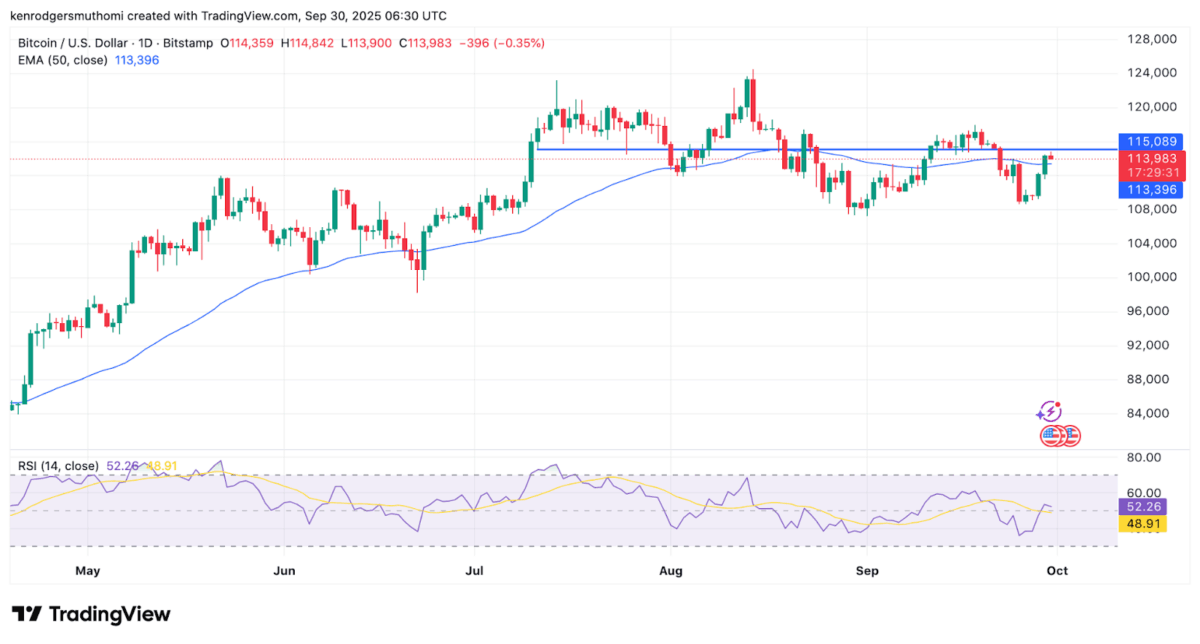

Bitcoin is trading slightly above its 50-day Exponential Moving Average (EMA) of $113,396, according to TradingView on a 24-hour chart. This indicator’s current state often signals the early stages of a short-term bullish shift. On the other hand, the Relative Strength Index (RSI) is sitting at 52.26, showing neutral momentum.

Analyst Crypt0pus noted on X that, “Bitcoin is rebounding from the horizontal demand zone within the descending triangle, indicating buying interest at lower levels.” However, he explained that the Ichimoku Cloud is still acting as a strong barrier. He added, “A decisive breakout above both the pattern and the cloud would confirm bullish momentum and could trigger a strong upward move.”

On-chain metrics point to opportunity

Rekt Fencer, a well-known analyst, pointed out that Bitcoin’s Short-Term Holder MVRV metric has recently fallen into oversold territory. According to him, it has historically indicated market bottoms.

Similar declines at $24K, $49K, $74K, and $109K have previously been followed by notable rallies. Furthermore, once October gets underway, the present reading suggests that there will be another bounce.

Meanwhile, Dan Tapiero argued that Bitcoin’s bull market has not started yet, despite the volatility. “Wake up. A bull market in Bitcoin has not started yet,” he said, citing macro tailwinds such as falling U.S. dollar strength and growing ETF momentum.

As of now, Bitcoin faces heavy resistance at $115,000, yet multiple indicators hint at renewed upside potential for Uptober month that could prove decisive movements to the largest cryptocurrency.

Also Read: Zcash Soars 25% as Privacy Upgrade Fuels Breakout