Poland’s lower house of parliament, the Sejm, passed the “Crypto-Asset Market Act” on Friday, establishing a formal regulatory framework for the digital asset industry.

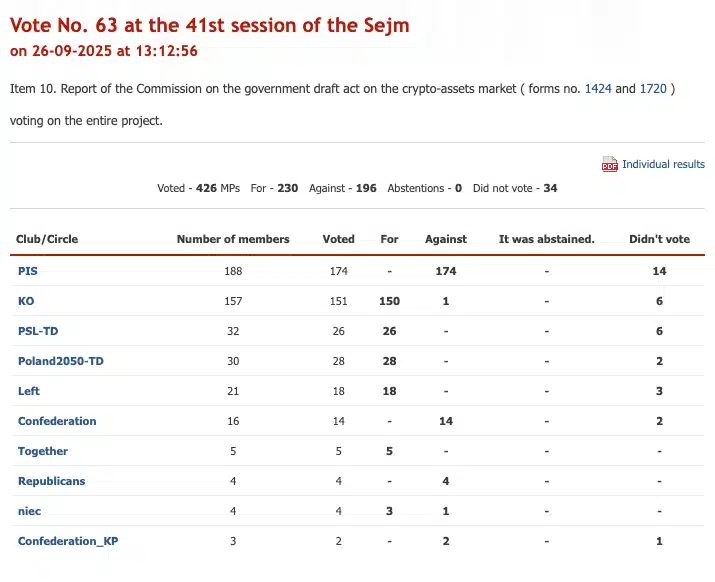

The legislation, approved with a vote of 230 in favor and 196 against, places crypto asset service providers under the authority of the country’s top financial regulator.

This move aims to implement the European Union’s Markets in Crypto-Assets (MiCA) regulation, standardizing rules across the bloc.

Poland’s Crypto Legislation Overview

The legislation, detailed in Bill 1424, officially designates the Polish Financial Supervision Authority (KNF) as the primary oversight body for the crypto sector. This places digital asset companies under the same supervisory umbrella as institutions like banks and insurers.

According to the official vote process, the bill passed with support from opposition parties, while the governing PiS party voted against it. The legislation will now proceed to the Senate for further consideration.

What the new licensing regime means for crypto providers

Under the new act, Crypto Asset Service Providers (CASPs) operating in Poland will be required to obtain a license from the KNF to operate legally. The framework introduces guidelines and aims to standardize operations within the Polish crypto ecosystem.

The law includes strict penalties for non-compliance. Violations could result in fines of up to 10 million Polish zlotys and potential prison sentences of up to two years.

Broader implications for Poland’s market and EU alignment

This legislation precedes the institutionalization of cryptocurrency. By following the EU’s MiCA states, Poland looks to meet its standards, which could attract institutional investment seeking regulatory clarity.

While the law provides a clear structure, some critics have raised concerns that the strict penalties and regulatory oversight could be perceived as overly restrictive, potentially impacting innovation.

The act represents Poland’s crypto industry interests, which aims to establish more regulation, so It could join a growing trend of national governments integrating digital assets into regular financial systems.

Also read: Société Générale and Bullish Launch First MiCA-Regulated Stablecoin