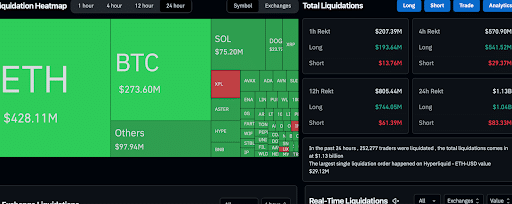

The cryptocurrency market witnessed one of its sharpest corrections today, with over $1.13 billion worth of liquidations occurring across all major exchanges in the last 24 hours. The sell-off was primarily driven by traders who were long, means the ones who had bet on price increases .

According to the data from Coinglass, about $252,502 traders were liquidated from their positions. Of the total amount, $1.04 billion came from long positions, while $83.88 million was liquidated from short positions.

Ethereum leads liquidations

The liquidation wave hit the Ethereum (ETH) recorded the heaviest losses with over $428.11 million liquidated in a single day. Bitcoin(BTC) followed behind with $273.60 million in liquidations, while Solana recorded $75.20 million.

Other altcoins like Avalanche (AVAX), XRP, and Dogecoin(DOGE) also added to the sell-off. The single largest liquidation order, valued at $29.12 million, was recorded on Hyperliquid in the ETH-USD market.

Coinglass heatmap showed that Ethereum’s dominance in this wipeout was overwhelming as traders who had bet on the price going up face the majority of losses. An unlucky trader alone lost $45M during the dump. According to a previous report, the trader also took a bet on Ethereum surge but lost his position as the price dropped below $4000 and left the trader with less than half a million dollars in the account.

At the time of writing, the price of ETH is trading at $3,924, down from its daily high of $4,273. Bitcoin also dropped from its intra-day high of $113,660, and is currently trading for $108,823. The overall market valuation is down by 3.95% to $3.73 trillion, according to CoinMarketCap.

Also Read: Hack Turns $GAIN Into Pain, Griffin AI Token Crashes 84%