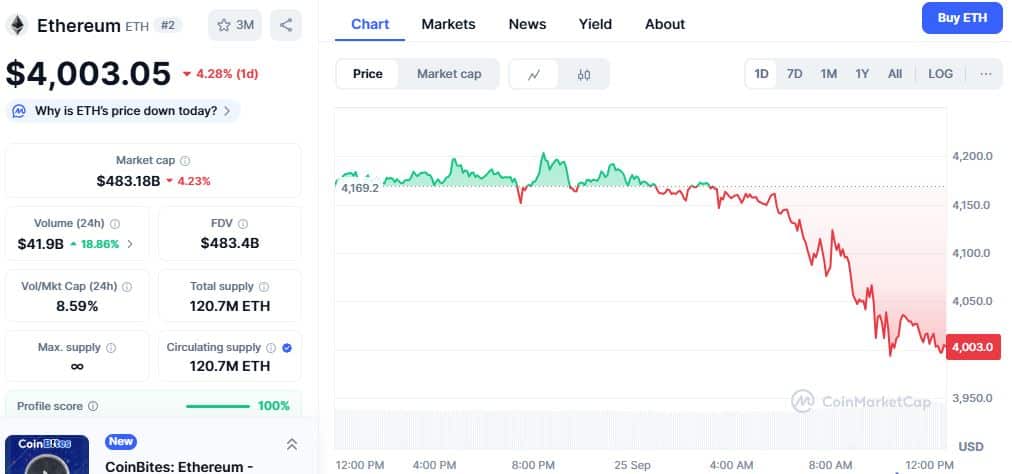

Ethereum (ETH), the world’s second-biggest cryptocurrency, took a sharp hit on Wednesday, losing about 4.28% in a single day and trading near $4,003.05, after it crashed to $3,966. The broader crypto market also fell 1.35%, but Ethereum’s decline was stronger, drawing attention from traders and investors alike.

The market cap of ETH currently stands at $483.18 billion, and the 24-hour trading volume is valued at $41.9 billion, pumping 18%.

Massive liquidations shake traders

A major reason for the drop was forced sell-offs, or liquidations. In the past 24 hours, $178.55 million in Ethereum positions were wiped out. Of this, $160.04 million came from traders betting on a rise in price, while $18.51 million came from those betting on a fall.

Across all cryptocurrencies, total liquidations hit $407.22 million, with $333.14 million in long positions and $73.94 million in shorts. Over 128,926 traders were impacted during this period. The largest single loss in the market came on Hyperliquid, where an ETH-USD position worth $29.12 million was liquidated.

Bitcoin also faced heavy liquidations, totaling $57.07 million. Of this, $42.08 million came from traders betting the price would go up, while $15 million came from those expecting a fall. The wave of selling pushed Ethereum from nearly $4,500 down to about $4,075, before it recovered slightly to around $4,200.

Withdrawals weigh on ETH

Investors pulled around $196.6 million from Ethereum funds following the U.S. Securities and Exchange Commission’s rule update. While these changes provide long-term clarity, many short-term traders took money out, reducing immediate buying interest and adding to the market’s downward pressure.

Ethereum’s price has been closely tracking Bitcoin over the past month. The two coins have moved in near sync, and Bitcoin currently trades around $111,880, down about 3% since Monday.

Overall market

The total value of all cryptocurrencies dropped to about $3.82 trillion, a fall of 1.57%. At the same time, Ethereum’s trading activity increased, with a volume of $41.94 billion, showing more trading as prices fell. Investors are also keeping an eye on bigger events, like a possible U.S. government shutdown, which now has a 77% chance according to Polymarket.

Ethereum is approaching an important level at $3,900. If it stays above this, the price could steady, but if it falls below, more selling might follow. Traders are keeping a close eye on the market as price movements and external events continue to influence cryptocurrencies.

Also Read: Hack Turns $GAIN Into Pain, Griffin AI Token Crashes 84%

Disclaimer: The Crypto Times does not endorse or recommend any specific cryptocurrencies, tokens, projects, financial products, or investment strategies. We do not accept legal liability for any financial losses incurred as a result of reliance on information published by us. Readers should always do their own research (“DYOR”), consult with licensed professionals, and evaluate risks independently.