While the institutional interest in Ethereum (ETH) is rapidly increasing, its supply on centralized exchanges has hit its lowest point since 2016, indicating a significant shift in the market.

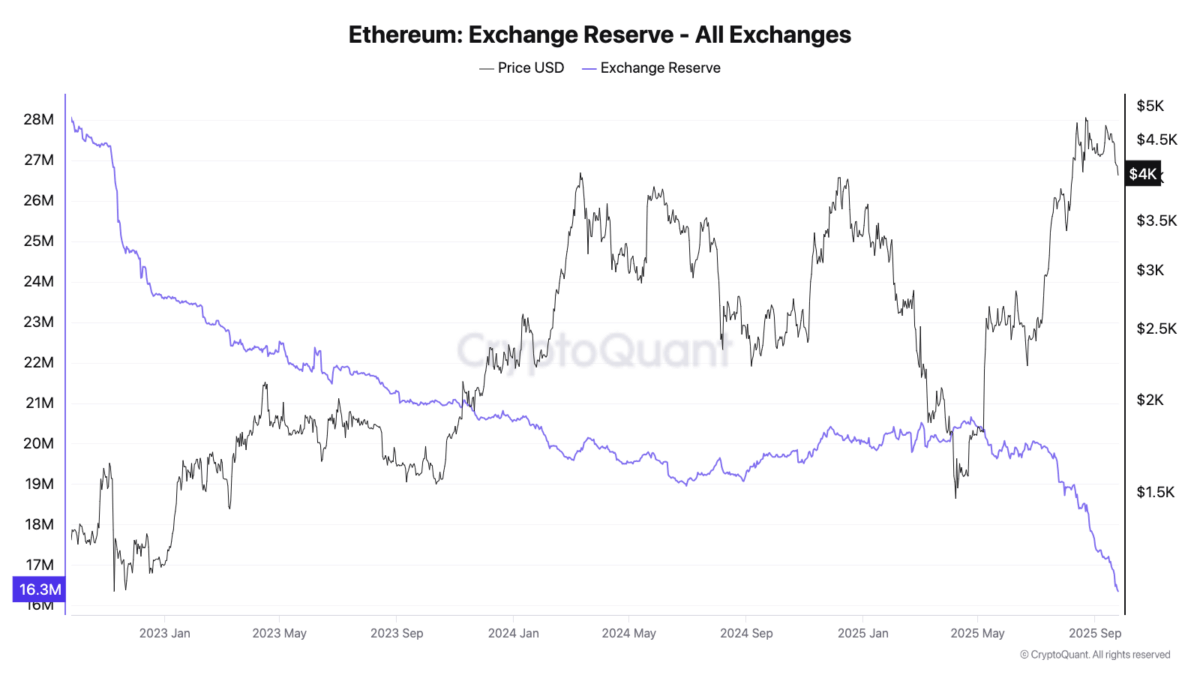

The latest data as of September 2025, the figure has dropped to 16.3 million ETH, marking the lowest level in nearly a decade. Throughout this period, Ethereum’s price has seen fluctuations.

According to Cryptoquant data, Ethereum exchange reserves have seen a notable dip in the last two years. The total ETH supply on exchanges was nearly 28 million at the start of 2023. It closely matches with the increasing price in ETH.

As per CoinMarketCap, Ethereum is currently trading at $4,030, down 3.5% over the last 24 hours, with a daily trading volume of $42.74 billion. It dipped below $2,000 in early 2023, surged past $4,000 in mid-2024, briefly fell under $2,000 again in early 2025, and has now bounced back to $4,000.

CryptoOnchain shared on X, “Ethereum exchange outflows hit a two-year high! Large-scale withdrawals often indicate a shift toward self-custody or DeFi deployments.” Historically, such massive outflows have signaled bullish trends.

Institutional treasuries drive accumulation

Institutional treasuries have accelerated accumulation since June. Analyst Rachael said, “Ethereum is getting the Wall Street glow-up. Treasuries are stacking ETH, exchange supply hits nine-year low, and Tom Lee’s calling US$10K to US$15K by year-end.”

BitMine alone now holds 2.4 million ETH, over 2% of the total supply. Since April, 68 entities have acquired 5.26 million ETH, worth about $21.7 billion, according to StrategicEthReserve. Most of these holdings are staked for yield rather than stored on exchanges, further tightening supply.

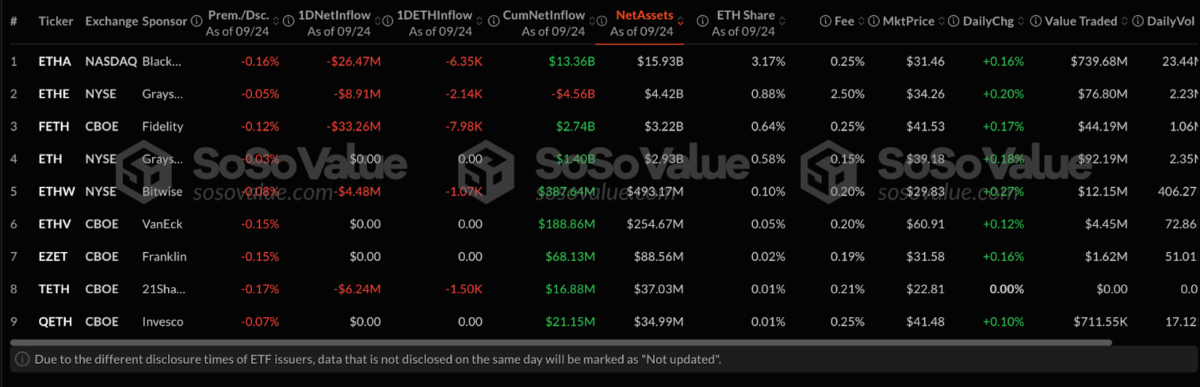

Meanwhile, Ethereum ETFs are seeing mixed results, as per Sosovalue data. BlackRock’s ETHA remains dominant with $15.93 billion in net assets but faced a $26.47 million outflow on September 24. The biggest daily outflow, $33.26 million, was recorded by Fidelity’s FETH, indicating a change in investor opinion.

Falling exchange supply and institutional buying suggest growing confidence in Ethereum’s future. With less ETH available for sale, upward price pressure could intensify if demand continues to rise.

Also Read: ETH Struggles to Hold $4K, As Bitcoin Battles for $110K Support