Abraxas Capital is ramping up its bearish bets as selling pressure builds across the crypto market. Data from HyperInsight shows the fund’s wallet (0xb83) added another 2 million ASTER tokens to its short positions in just two hours.

As noted by HyperInsight in a Telegram post, this brings Abraxas Capital’s total position to nearly $4.04 billion. The wallet’s unrealized profit has climbed to $9.46 million, while weekly gains have jumped to $54.31 million.

Besides Aster, the fund is holding significant short positions in major assets. Abraxas currently carries about $146 million in Ethereum shorts, another $110 million in Ethereum, and $49.5 million in Solana.

Whales move in opposite directions

Meanwhile, large holders are displaying mixed behavior. Spot On Chain reported that whales “0xFB3” and “0x5bd” accumulated $62.5 million worth of ASTER within the last day.

Wallet 0xFB3 now holds 50 million ASTER worth $105 million after repeated withdrawals from Gate.io. Wallet 0x5bd also increased its bag to 8.28 million ASTER after fresh withdrawals from Bybit.

Olaxbt confirmed this trend on X, stating: “Abraxas Capital’s sleek flow: ~846M total position, $41M+ ETH short squeeze. ETH & SOL impacted—soft currents shift.?”

Market signals flash bearish

Olaxbt further shared a chart showing Bitcoin (BTC) slipping from $117,800 to $111,673, intensifying selling pressure intensified with volume spikes during price drops.

The Cumulative Volume Delta (CVD) is showing lower highs, which is definitely a bearish sign. Moreover, the Money Flow Index (MFI) has dropped to 26.70, getting close to oversold territory. This could mean that BTC might experience a short-term bounce, but it’s still facing significant downside risks.

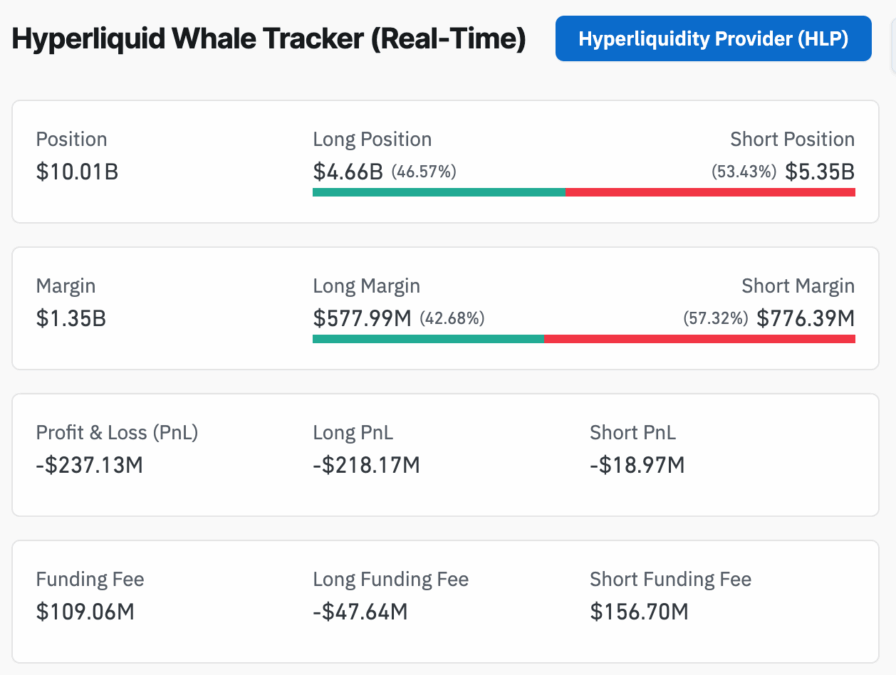

Furthermore, according to Hyperliquid Whale Tracker, whales own $10.01 billion in assets. At $5.35 billion, shorts outnumber longs at $4.66 billion. Long exposure is the primary cause of the -$237.13 million in unrealized losses.

In contrast, longs pay $47.64 million in funding costs, while shorts receive $156.70 million, making them the preferred option.

Abraxas Capital’s heavy shorting shows that big players are betting on prices dropping. If selling keeps building on ASTER, ETH, and SOL, the market could get even more volatile.

Also Read: Millions Liquidated after Ethereum Price Drops 4.2% in 24 Hrs