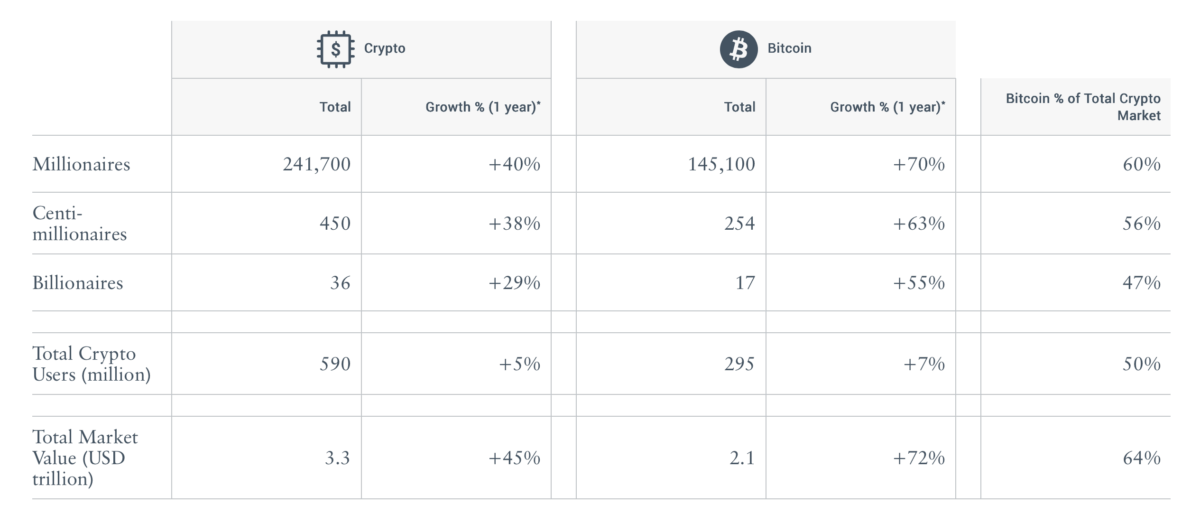

The number of people who became millionaires from the cryptocurrency space has jumped to 241,700 as of June 2025, according to Crypto Wealth Report 2025 released by Henley & Partners in collaboration with New World Wealth.

Bitcoin Led Wealth Creation with 45%

According to the research, this is 40% more compared to last year, with a total wealth valued at $3.3 trillion, up 45% from 2024. Bitcoin took the lead with the number of Bitcoin millionaires climbing 70% to 145,100 holders, while 17 of the 36 global crypto billionaires gained most of their fortunes from Bitcoin.

The report further says that 450 people now own more than $100 million or more in crypto, which is 38% from last year. The report described this as a “historic” wealth boom, thanks to institutions that are now taking interest in the market, and the increase in use globally.

Overall, about 590 million people, roughly 7.4% of the world’s population, own cryptocurrency today, with 295 million holding Bitcoin. However, crypto millionaires represent only 0.4% of the world’s 60 million millionaires, according to UBS.

More Real Life Use Than Before

Dominic Volek, head of private clients at Henley & Partners, explains in a post on X that crypto wealth is now deeply tied to global mobility and investment choices.

“Our data-driven evaluation of the world’s most crypto-friendly investment migration programs empowers clients to build globally diversified portfolios of alternative residence and citizenship options — unlocking tax efficiency, asset protection, and mobility in a world where geography is no longer a constraint, but a choice.” he wrote

Meanwhile, governments are also beginning to adapt to this borderless wealth. For instance, countries like St. Kitts & Nevis, Panama, and the UAE now accept crypto payment for real estate tied to citizenship or residency programs.

“These programs only started accepting crypto in late 2023 and 2024, so there’s years of pent-up demand finally finding an outlet,” he said. For many investors, paying with crypto is not only faster but can be used to avoid taxes and fees that come with converting digital assets into traditional currency.

The Future of Borderless Wealth

However, Regulators still remain worried about how volatile the market is. Also the matter of money laundering is still a concern as well. But Volek argues that blockchain often makes money trails clearer than traditional banking.

The report also ranked the most crypto-friendly countries based on regulation, taxation, infrastructure, and innovation. Singapore, Hong Kong, and the United States lead the list, while the UAE and Monaco attract investors with zero taxes on crypto trading and income.

Also Read: Société Générale and Bullish Launch First MiCA-Regulated Stablecoin