Bybit, the world’s second-largest exchange by trading volume, has upgraded its traditional finance (TradFi) platform, letting traders buy and sell stock CFDs anytime, five days a week.

Previously, Bybit users could only trade during U.S. market hours, roughly 6.5 hours daily. This shift removes barriers for global traders who struggle to manage positions outside market hours.

According to the announcement, the update covers 20 top stock CFDs in its initial rollout. These include tech leaders like NVIDIA, Meta, and MicroStrategy, as well as crypto-linked equities such as Coinbase and Circle. Moreover, Bybit now supports over 100 equities, giving traders access to a wide range of U.S. and global assets.

Bybit’s strategic moves beyond trading

Bybit has been busy with other developments. On September 19, it announced teaming up with Qatar’s QNB Group and DMZ Finance to launch QCDT. This tokenized money market fund, approved by the Dubai Financial Services Authority, is backed by U.S. Treasuries and now available as collateral on the platform.

Furthermore, on September 22, Mantle’s MNT token surged 8% after Bybit announced exclusive benefits for holders, including improved leverage terms and discount buying options. Mantle was among the top 20 cryptocurrency posting gains that day.

Increasing popularity of decentralized stock trading

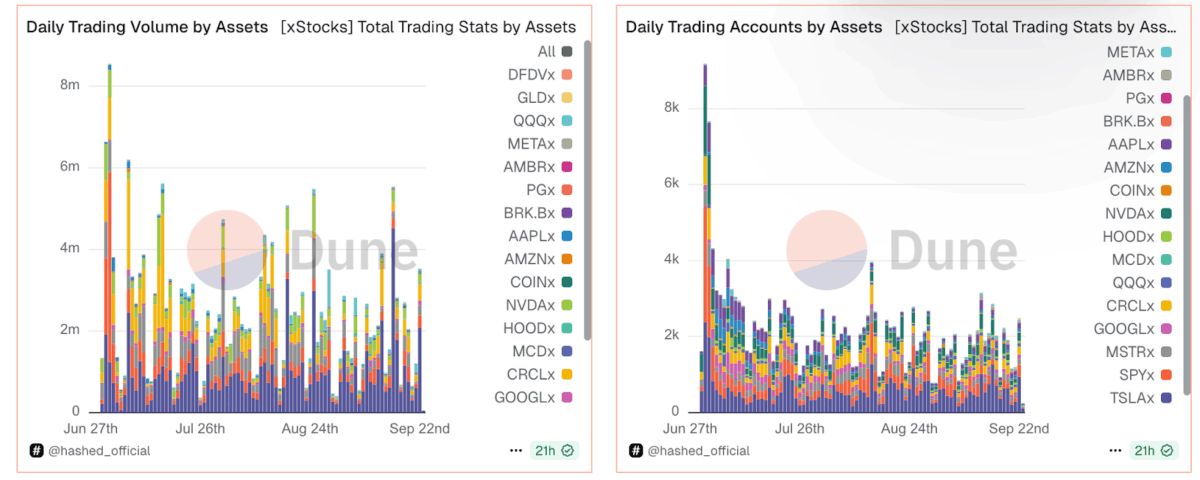

Decentralized stock trading is picking as more traders get into blockchain-based assets. According to data from Dune, daily trading volumes for stock-related crypto assets shot up to over $8 million in June before settling into a more consistent pattern, now sitting at a cumulative trading volume of $210 million.

The number of active trading accounts followed suit, starting off above 8,000 and then stabilizing between 1,500 and 3,000, reflecting that initial excitement followed by steady participation. Popular tokenized stocks like AAPLx, AMZNx, and COINx have been key players in this growth.

Also Read: FG Nexus Hits 50,000 ETH Treasury Milestone, Shares Rise