Aster, a decentralized derivatives exchange, has activated 300x leverage trading for the token $HYPE, in a response to user requests for higher-risk exposure. The feature allows traders to open outsized long or short positions, marking a notable escalation in risk appetite among on-chain platforms.

The exchange clarified that the listing does not imply endorsement and warned users to trade only assets they understand. While the mechanics of 300x leverage can amplify returns, they also magnify losses.

This development at Aster reflects a growing trend in the DeFi space, as decentralized exchanges begin to offer financial tools and features that were once primarily available on centralized platforms. With competition in the perpetuals market intensifying, some protocols are adopting more aggressive features to attract traders.

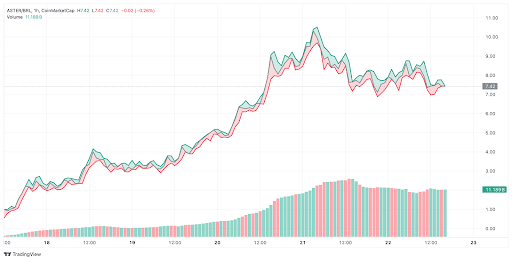

Dual-mode trading and $1B TVLAster’s infrastructure spans BNB Chain, Ethereum, Arbitrum, and Solana, allowing for multichain access with relatively low fees. Since the launch of its native token, the platform has reported sharp growth: $310 million in trading volume within 24 hours, roughly 330,000 new wallets, and total value locked exceeding $1 billion.

The introduction of 300x leverage on $HYPE is part of the platform’s dual-mode interface, which is designed to cater to a range of traders. One mode targets newer traders with simplified access and high leverage, while the other mirrors the layout and depth of traditional exchanges. The addition of such high leverage, however, has raised concerns that it may encourage more speculative trading activity on the platform.

Also Read: Aster Hits $1B TVL, 330K Users After Token Launch