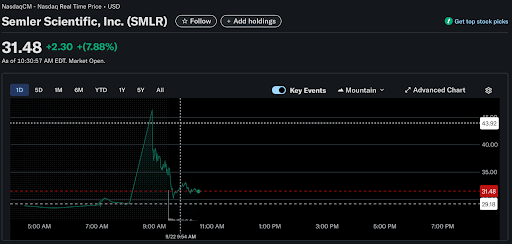

Shares of Semler Scientific Inc. (SMLR), a digital health tech firm, surged by 7.88% today after Strive Inc. announced that it has agreed to buy it in an all-stock deal that would bring together two of the first public companies holding Bitcoin (BTC) as their main reserve.

According to the deal, every Semler share will be exchanged for 21.05 Strive Class A shares. Based on the market price from September 19, this means about $90.52 for each Semler share. That is more than 200% higher than Semler’s last closing price of $29.18 before the announcement. Both Strive and Semler said their boards approved the merger without objections.

Shortly after the news was shared, Semler Scientific shares jumped to $32.50 before settling at $31.48.

Plans to build a bigger BTC treasury

Aside from the merger, Strive also said it bought 5,816 BTC at an average price of $116,047 per coin. The total cost was about $675 million. With this, the company now owns 5,886 BTC. When combined with Semler’s Bitcoin reserve, both hold nearly 10,900 BTC together.

According to the press release, the firm is exploring ways to “monetize or distribute” Semler’s profitable diagnostics business in the future. This means they may sell, or share profits from Semler’s medical unit. Strive added that it wants to use a “preferred equity only” model, which would allow it to avoid debt.

“This merger cements Strive’s position as a top Bitcoin treasury company, and we believe our alpha-seeking strategies and capital structure position us to outperform Bitcoin over the long run. This transaction showcases how we can grow Bitcoin holdings and Bitcoin per share at an unmatched pace in the industry to drive equity value accretion,” said Matt Cole, Chairman and CEO of Strive.

How both firms entered the crypto space

Strive, which is based in Dallas, has been reshaping itself this year to get involved in the Bitcoin Space. Early this month, it also completed a merger with Asset Entities Inc., a digital marketing company, which was its foundation to build its own Bitcoin treasury. The firm is also known for managing exchange-traded funds, such as the $1 billion Strive 500 ETF.

Semler Scientific, on the other hand, is based in California with an initial focus in the healthcare sector. The company designs and sells diagnostic devices that help detect diseases, including those related to heart and vascular health. However, it ventured into the financial market in 2023, becoming one of the first medical firms to adopt BTC as its main reserve asset.

Meanwhile, both firms followed the strategy used by MicroStrategy, led by Michael Saylor, which stands at the top corporate firm with the largest Bitcoin Holding. This is about 639,835 BTC acquired at $72,971 per coin.

Also Read: Metaplanet Buys 5,419 BTC, Total Holdings Reach 25,555 BTC