Another shareholder lawsuit against Bitcoin treasury giant Strategy has been dismissed, court records show. Filed in June by Abhey Parmar and Zhenqiu Chen, the case claimed breaches of fiduciary duty, unjust enrichment, abuse of control, and gross mismanagement.

This follows a similar May lawsuit that accused Strategy of misleading investors on how new accounting rules might affect profitability. Multiple law firms often file nearly identical suits to compete for lead counsel in consolidated cases, making these dismissals fairly common.

Strategy’s Bitcoin Holdings Soar

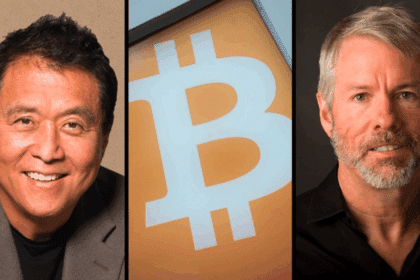

Strategy, formerly MicroStrategy, is the world’s largest corporate holder of Bitcoin, owning 638,460 coins worth about $72.5 billion. While it originally sold data analysis software, the company now focuses on buying and holding Bitcoin. Investors can gain crypto exposure by buying its Nasdaq-listed stock (MSTR).

Co-Founder Michael Saylor started accumulating Bitcoin in 2020, calling it the best way to store value and save shareholders’ money. Since Strategy’s first Bitcoin purchase, its stock has jumped from $14 to $423, a stunning 3026.92% gain.

Additionally, the company has faced regulatory issues before. In 2000, Saylor, Co-Founder Sanjeev Bansal, and former CFO Mark Lynch settled with the U.S. Securities and Exchange Commission (SEC) over overstated revenue and earnings, paying $11 million in penalties without admitting wrongdoing.

Class Action Suit Ended

Recently, Michael Saylor and Strategy’s investors voluntarily ended a class action lawsuit that had accused the company of making false statements about its Bitcoin strategy. Filed in May by Pomerantz LLP, the suit also named CEO Phong Le and CFO Andrew Kang as defendants, citing overstated profits and understated crypto risks.

The dismissal comes as Strategy’s Bitcoin treasury continues to grow, now valued at around $68.5 billion. With shares up over 152% in the past year, the company’s strong growth and cleared legal hurdles reinforce its goal of becoming the largest corporate player in Bitcoin investment.

Also Read: Strategy Scoops up Another 1,955 BTC for $217 Million